What is the optimal long-term strategy for investing?

Important Considerations

Before we get into the strategy itself, it is essential to cover off a few key introductory points that should always be taken into consideration when investing. To successfully invest for the long term, it is crucial that you have a solid foundation from which you can build. Many of these points may seem straightforward but they are vital for putting your money to work over the long-term, and a financial adviser will easily be able to help with how to approach these.

- Firstly, get your finances in order: having a clear understanding of your assets and debts is very much the first stage of investing. It is the platform from which you will build your portfolio.

- Consider the tax implications: paying an unnecessary tax bill can easily negate hard-earned profits from your investment portfolio. However, if avoiding tax is your primary driver, you may find yourself making decisions that ultimately harm your portfolio’s return. ‘Do not let the tax tail wag the investment dog’.

- Match your investments with your time horizon: this is key to ensuring that you are rarely forced to sell at a loss. In the short-term, markets can be incredibly volatile and hard to predict. Over longer periods, the environment becomes rather more stable. For example, were you to invest in the MSCI World for any twelve month period over the last fifty years, you would have a 74% chance of finishing with more money than you started. If instead you invested over a five-year period, this increases to 87%. Extend this further to a ten-year period and your portfolio would have made a positive return 100% of the time.

Modern Portfolio Theory

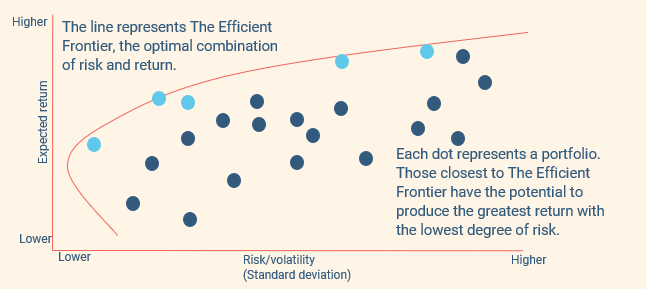

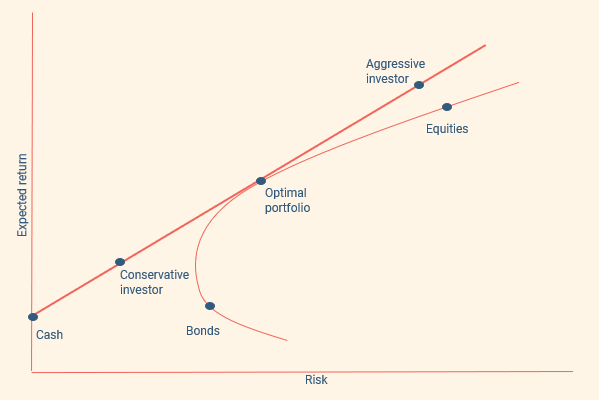

Assuming you have the foundations in place then, what is the optimal strategy for investing? There are a number of theories that have underpinned investing in recent years that may help us discern the best possible strategy for investing over the long-term. Modern Portfolio Theory (MPT) states that for each given level of risk, investors should construct portfolios to maximise their expected returns. To do this, each investment should not be analysed on a standalone basis, moreover, it should be evaluated on how it affects the overall portfolio’s risk and return profile. An asset with a low correlation to the rest of the portfolio may still be beneficial to hold, even if it has a higher risk or lower return than the other constituents. For example, adding 10% of your relatively safe gilt portfolio, into more volatile UK smaller companies, not only increases your potential return but reduces the overall portfolio risk.

MPT states that it is possible for an investor to reduce risk simply by holding a combination of instruments that are not perfectly positively correlated with each other. The less correlated the assets, the greater the risk of the portfolio deviating from a weighted sum of its parts. Two uncorrelated assets may sometimes still move in lockstep (they are uncorrelated not negatively correlated after all). If you extend this to 3 or 4 uncorrelated assets though, the chance of this occurring decreases which, in turn, reduces the volatility of your portfolio.