Stronger relationships, smarter wealth management: meaningful outcomes.

Build your wealth in three simple steps...

Match

We’ll start by matching you with the perfect adviser from our expert team.

Plan

Next, we take a deep dive into your unique needs, ambitions and goals to help form a plan.

Build

Last step: you get a tailored financial plan which maps out your journey towards building your wealth.

About Saltus

Our wealth management services

You can rest assured when you have a clear plan for the future.

- Pensions and retirement planning

- Reducing your tax burden

- Consolidating your wealth

- Protecting you and your assets

- Passing on your wealth

- Advising on significant life events

Unconstrained multi asset class investors with an award winning track record.

- Asset allocation and portfolio construction

- Manager selection

- Risk management to align with your plan

- Active, passive and sustainable strategies

- A strong track record

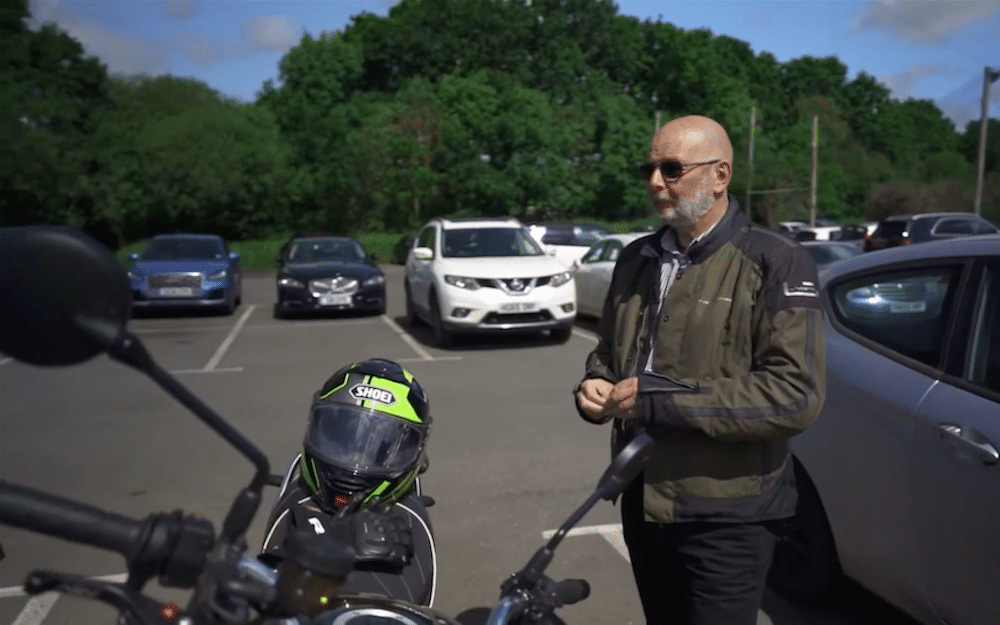

We pair you with the right adviser for the perfect match

Finding the correct financial adviser can be challenging

When you first contact us, a specialist team will speak with you to understand your circumstances, financial objectives and what’s important to you. They’ll then match you with the most appropriate adviser based on their background and expertise. Some Saltus advisers specialise in retirement planning, for example, whilst others might focus on working with entrepreneurs. Your financial journey should begin with the right partner for you.

Meet the teamWe put clients at the heart of everything we do

Don’t just take our word for it

We have longstanding relationships with our clients, and the plans we create together can have significant benefits for their financial futures. Our clients explain how we do this better than us though. Watch our client testimonial videos to find out more…

What our clients say about us

Award winning wealth management

We're proud of our numbers

We have a long track record of producing superior risk-adjusted returns

A Saltus client that started with £750,000, over 10 years, could have ended up with:

Saltus:

£0

Saltus: Multi Asset Class Balanced (PA)

Our competition:

£0

ARC Sterling Balanced Asset PCI TR

Difference:

£0

Past performance is not a guide to the future. Investments do not guarantee a return, the value and the income from them can fall as well as rise. You may not get back the amount originally invested. Source: FE Analytics/Saltus. Full calendar years from 2015 – 2024. Performance is for the Saltus Multi Asset Class – Balanced (PA) portfolio, quoted net of third-party manager fees, the Saltus Asset Management DFM fee and the Saltus platform fee. Other fees may apply. The comparative benchmark shown is the ARC Sterling Balanced Asset PCI TR benchmark

Annualised performance disclosure

Growing strong, staying personal

We started life over 20 years ago to support our friends and family and now we serve the whole of the UK

We know that size, breadth of expertise and financial resilience are important to our clients. We’ve grown from strength to strength over the years in this regard. However, we never forget where we came from and still provide the level of service you can expect from a boutique wealth management house. Our Chartered Financial Planning status highlights how important the quality of our service and advice is to us.

Find out about usWhat industry experts say about us

Saltus stands out in the UK wealth management industry by blending personalised financial planning with a sophisticated investment approach more often found in institutional circles…Their planning process includes robust cashflow modelling and tax optimisation, resulting in comprehensive strategies that span life planning and investment management.

Your finances at your fingertips

We built our bespoke app with clients, for clients. Our industry-leading portal and app allow you to:

- View your entire family’s wealth in one place

- Understand how your wealth is growing and how your investments have performed

- See your different plans and detailed information with ease

The people at Saltus are knowledgeable, approachable, trustworthy and thorough in their approach as to what is best for your financial future

Retirement planning and pension specialists

Award winning investment management

Proprietary technology and app

Keeping your money safe and personal security are key priorities

We know that the security of both your assets and information is paramount when it comes to entrusting us with your money

We put multiple layers of protection in place to help secure both your assets and your data. From ring-fencing your money with a dedicated custodian to stress testing our technology defence measures, we’ve got it covered.

How we keep your money safe

We’re always on top of current financial affairs

Whether it’s financial news, changes to legislation or tax allowances, we keep our clients informed

You can get to grips with our views by browsing our financial planning blog or flicking through our investment management insights. Alternatively, read one of our financial guides or familiarise yourself with the Saltus Wealth Index to discover more about the UK high net worth landscape.

Autumn Budget Webinar

13 November 2024

Watch

One high earner in the household? Key financial planning steps to avoid overpaying tax in retirement

17 October 2023

Watch

How much do you need to retire and more…

How much income do you need to be comfortable, how much do you need invested and how to pay less tax... Read more Read more

Read more

How can our wealth management services help you?

Financial planning isn’t just about number crunching…

It’s about working closely with you to determine what you want from life and how your finances can achieve it. Our financial advisers work in partnership with you to maximise your wealth, reduce your tax burden, and avoid potential pitfalls. Together, we create a bespoke financial plan, followed by an investment strategy designed to deliver it. This can be supported by solutions from the wider market or provided by Saltus Asset Management.

We offer holistic wealth management services, source insurance when needed, and can implement any necessary tax wrapper via our in-house platform.

Our asset management business brings decades of investment management expertise to the table…

We’re experienced across all asset classes but have particular strengths in private equity and alternative investment strategies. The team delivers a high calibre institutional service and offers private clients a unique opportunity to access an investment style that is typically unavailable in the UK marketplace.

Risk is actively managed, with a focus on generating risk adjusted returns driven primarily through the skill of carefully selected managers. This award-winning approach is designed first and foremost to meet our clients’ objectives.

Frequently asked questions

What is wealth management?

Wealth management is a personalised financial service that helps individuals and families grow, protect, and transfer their wealth. It combines investment management, financial planning, tax strategies, and estate planning into one comprehensive approach. At its core, wealth management is about aligning your financial resources with your life goals.

Who needs wealth management?

Wealth management is ideal for individuals and families who want to build their wealth or need to rely on it for income, such as during retirement. It is also well-suited to those with complex financial needs who require assistance with tax structuring. Typically, wealth managers work with individuals looking to invest £250,000 or more.

What is private wealth management?

Private wealth management is a specialised financial service tailored to high net worth and ultra-high net worth individuals and families. It offers a personal, comprehensive approach to managing wealth. This includes establishing an investment strategy, estate and retirement planning, tax services, and generational wealth transfer.

What is the role of a wealth manager?

A wealth manager serves as a trusted adviser, helping clients navigate complex financial decisions. Their role includes developing tailored investment strategies, optimising tax efficiency, planning for retirement, managing risk, and coordinating estate and legacy planning.

How do I choose a wealth manager?

Look for a wealth manager with proven experience, relevant qualifications, and a strong track record serving high net worth clients. Prioritise those who offer personalised, comprehensive services and can demonstrate that their clients are satisfied from their experience with working with them.

At what point do I need a wealth manager?

You may need a wealth manager when either your financial situation becomes more complex, or your investments and savings reach a size where advice and support may be beneficial. There may also be an important life event such as retirement, selling a business or receiving an inheritance that could mean speaking to a wealth manager and developing an ongoing relationship with a wealth management firm is helpful.

What is the Saltus Wealth Index?

The Saltus Wealth Index measures the confidence and concerns of high net worth individuals in the UK. Surveying 2,000 people with over £250,000 of investible assets biannually, it tracks key financial and economic indicators to provide insights into wealth trends and sentiment among affluent clients.