Given the extreme market volatility over the last few trading sessions, we wanted to provide an initial update on the Saltus portfolios and outlook, which we hope offers some clarity on the situation.

What has been happening in markets?

Following President Trump’s announcement of significant US trade tariffs on Wednesday 2nd April, stock markets across the world have fallen sharply as expectations for economic growth and corporate earnings have slowed.

In the weeks leading up to the tariff announcement, investors and market watchers weren’t sure what to expect. Riskier assets fell throughout March in anticipation of the announcement. Many were hoping for a simple structure, like a flat rate or a two- to three-tier system capped at 20%, and ideally the tariffs would be open to negotiation. When the announcement finally came though, the tariffs were more complex and much harsher than expected.

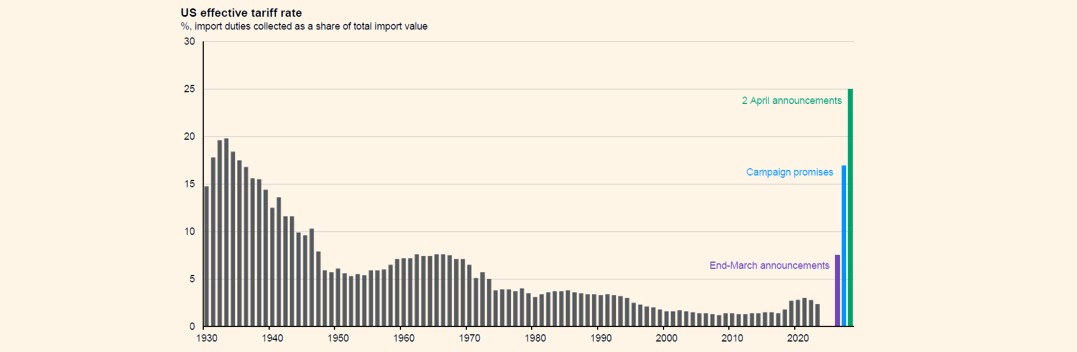

The selling in stock markets has been rapid and broad-based since then. Bond prices have risen as expectations for interest rate cuts have increased. Commodity prices have fallen as economic growth estimates have been revised down. The below chart (from the Cato Institute, US Department of Commerce & J.P. Morgan) highlights just how much larger the announced tariffs were than both history and recent expectations.