Despite our best efforts, many Saltus portfolios finished 2022 below where they had started. We know losses are never welcome, but we are content that our processes and philosophy helped client portfolios weather the storm through what was a challenging year. Our strategies finished the year significantly ahead of most competitor portfolios. In fact, our flagship portfolio range sits in the top 25% of the industry for every risk profile over one, three, five and ten years, as judged by an independent firm. Certainly, a difficult year, but at least relatively positive in comparison to our peers.

What follows is a quick review of 2022. We outline the key investment themes and the major decisions that affected performance – both the successes and the failures. We finish by discussing the outlook for 2023 and how we’re positioned at the time of writing (February 2023).

2022: financial markets

We entered 2022 with economies continuing to re-open from lockdowns but, with supply chains still stretched, this was inflationary. Then Russia invaded Ukraine. The West responded with sanctions, arms, and funding. The war turbo-charged the inflationary pressures because it acted like an additional supply shock, on top of the pre-existing Covid supply shock. Energy prices soared, with oil rising to nearly $140 a barrel. The prices of essential foods also rocketed, leading to civil unrest in many countries. Inflation reached double digits in some areas.

Britain saw two monarchs, three prime ministers, and four chancellors in 2022. The Kwarteng-Truss mini-budget caused mayhem in the government bond market, and the Bank of England had to step in to provide support, with several large pension funds narrowly avoiding collapse.

Further afield, President Biden approved $500 billion of new spending and tax breaks aiming to boost clean energy and reduce healthcare costs. Xi Jinping broke precedent by securing a third term as leader of the Communist Party, and his zero-Covid policy was all but abandoned after protests against Covid restrictions.

2022 saw a dramatic shift in the economic regime, moving from historically low inflation and interest rates to double digit inflation and rising interest rates, at a time when the financial system had never had so much debt, and liquidity was being squeezed out of the system. Markets did not like the transition.

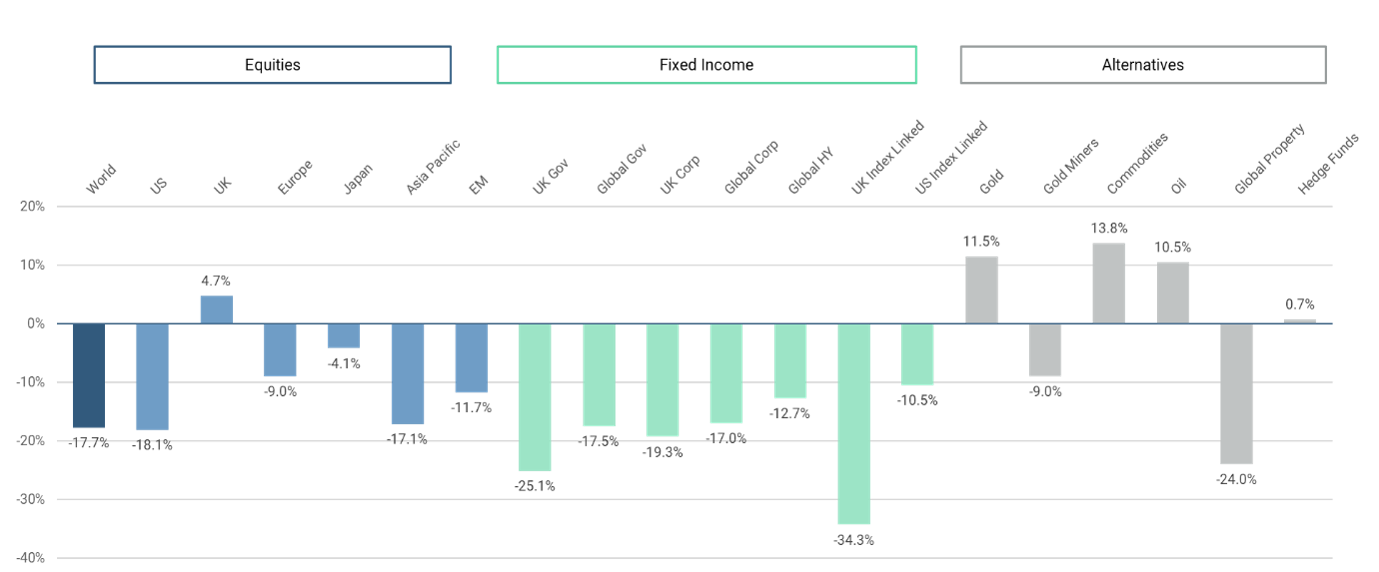

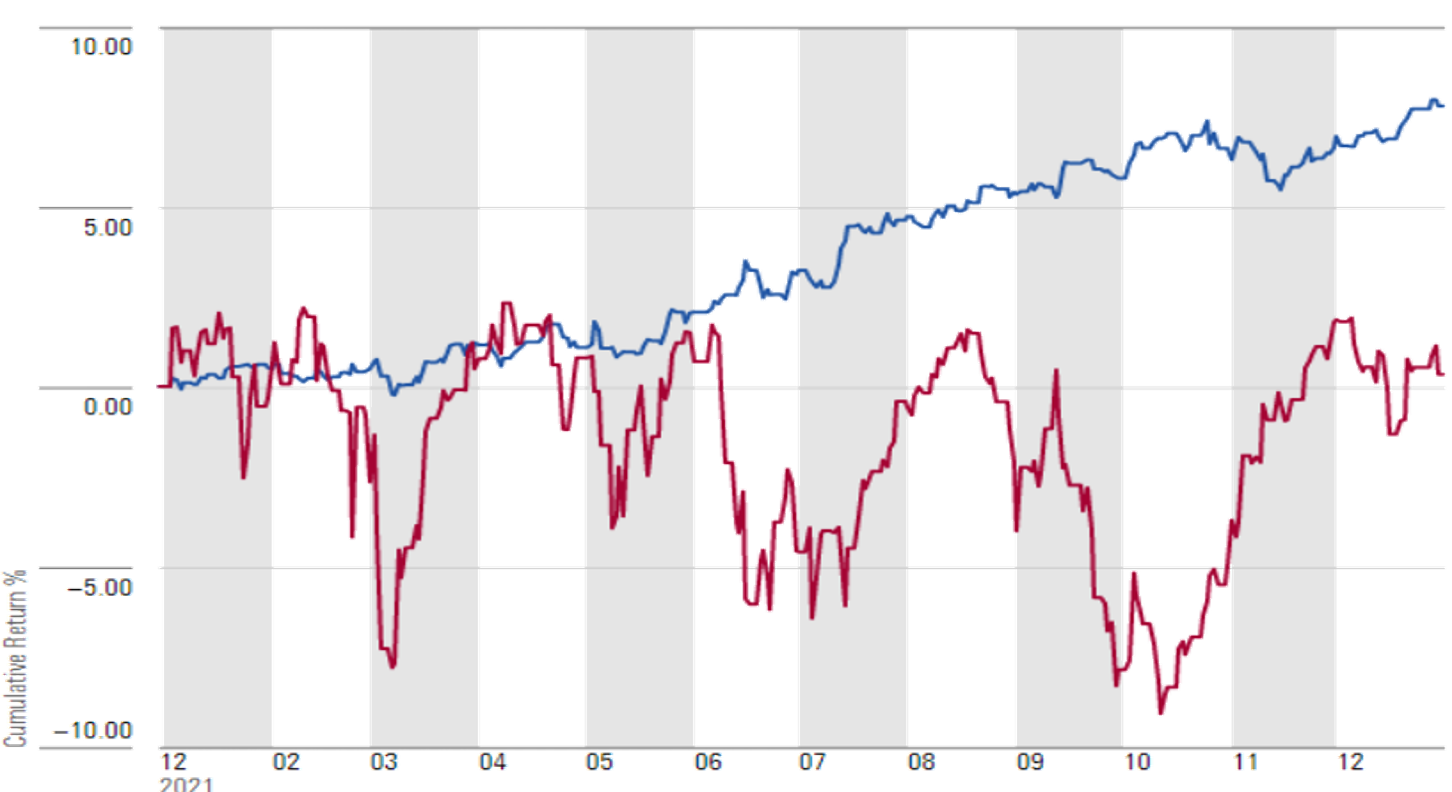

Stock markets fell around the world. Bonds also fell, which is an issue because they’re often relied upon to increase in value when stocks fall, thereby providing some protection to multi-asset portfolios. In fact, it was one of the worst years on record for a traditional medium risk portfolio of 60% shares and 40% bonds.