Alternatives: what are they, why they’re important and how Saltus use them

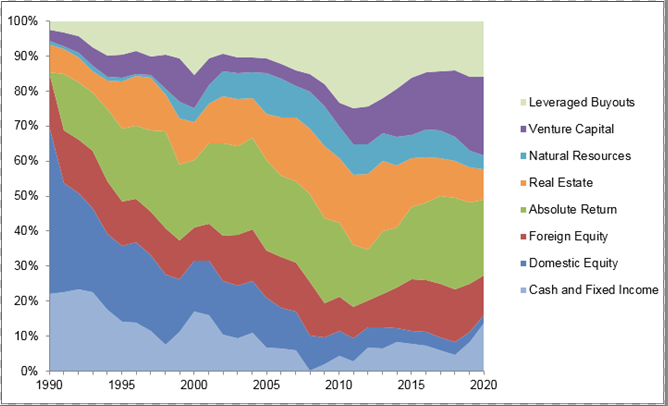

If any of our readers looked at the asset allocation tables of a typical institutional or retail portfolio anywhere in the world today, we think that they would be surprised to see how similar they all are. Regardless of who you are or where you lived, investments would be almost entirely distributed across the three mainstream asset classes of stocks, bonds and cash. However, usually tucked away in the corner of a portfolio, there should also be a small portion of the asset allocation given over to a mysterious group labelled as ‘alternatives’. This article intends to explore this often misunderstood part of the investment world and perhaps show that, in the end, they are not so mysterious after all.

The simplest way to think of alternative investments is to classify them as anything that isn’t a conventional ‘buy and hold’ stock, bond or cash position. By conventional, we mean something that is unleveraged, easily priced and usually dependent for a large part of returns on the overall market going up, rather than the individual position itself. The alternative world can then be thought of as everything else, covering a vast array of familiar and unfamiliar assets.

For example the property, commodities and private company markets are usually thought of as the main alternative asset classes. Although they are all familiar enough (housing, oil and the family business being examples in each category) they do bring with them additional features which conventional assets don’t have, such as complexity, illiquidity or the use of borrowed money, also known as leverage. These factors complicate matters when considering the potential risk/return profile of an investment to the extent that it seems to put off the majority of investors from making alternatives a meaningful part of their portfolios.

However these additional features are, in essence, also exactly what makes the alternatives world so attractive to those professional investors who are prepared to put in the work, as they offer up the tantalizing prospect of both additional returns and low correlation with mainstream assets.

There are many other types of alternative investments, outside of the familiar property, commodity and private asset segments. The most recognisable of these, such as art, wine or classic cars, also happen to be much smaller in size and, dare we say it, often carry more entertainment value than anything else. By far the biggest, most useful and widespread of other alternative investment possibilities lie in the derivatives market, where futures, options, swaps and forward contracts allow a manager to take on or offload portfolio risks in a very targeted manner. The breadth of what can be traded is quite staggering and the depth of the markets also huge, totalling over $12trn in gross value in 2021*.