Growth (economic)

Once again, the global economy has demonstrated its resilience, although a slight negative shift in momentum is evident. Recent trends in leading indicators have signalled a gradual cooling of most major economies. The key issue investors are grappling with is whether we will see recessions and, if so, what form those recessions will take.

Headline inflation has been falling but prices remain high, reducing spending and excess savings. Excluding shelter costs, annual inflation in the US is now at the Fed’s 2% target. Headline inflation remains high in many countries – recent Consumer Price Index (CPI) readings being 6.3% in the UK, 3.7% the US, 4.3% in the Euro area, and 3.1% in Japan – but, crucially, all have fallen over the last twelve months, excluding Japan. Inflation remains one of the key variables influencing central bank policy, economic growth (e.g., the likelihood of recession), and financial markets.

Higher interest rates and lending standards combine to make financial conditions tighter than in recent history, restricting finance (borrowing) by corporates and individuals, reducing growth.

Unemployment remains at or near historic lows in the Eurozone (6.4%), UK (4.3%) and US (3.8%), but these have increased in recent months. UK unemployment is at half its peak post 2008 Financial Crisis. Wage growth is robust, with the period from April to June exhibiting the most substantial regular annual growth rates observed since 2001, standing at an impressive 7.8%.

Looking ahead, the IMF expects global growth to fall from an estimated 3.5% in 2022 to 3% in 2023 and 2.9% 2024, below the historical (2000-19) average of 3.8%, but positive growth, nonetheless. These numbers could be boosted by an uptick in China’s economy, which is emerging from a soft patch, retail sales there were lifted by recent government stimulus and factory activity has stabilised after months of weakness.

Interest rate & liquidity environment

Most major economies have been raising interest rates in an attempt to cool inflation. However, interest rates are not expected to move much higher because inflation has been falling. The risk of a policy mistake by central bankers is elevated in our view. Reduce rates too soon and inflation could rise again, as was the case in the 1970s. But keeping rates too high for too long could damage companies and consumers with high debt levels. This is a difficult balancing act, especially since the impact of higher rates generally takes 12 to 24 months to be felt. China is stimulating activity via lower interest rates and increased liquidity.

Valuations & earnings outlook

At the global level, corporate earnings have been resilient, and higher than expected in many areas. However, the breadth of earnings is falling, meaning some sectors are struggling more than others. Profit margins were at record highs but have fallen slightly due to rising costs.

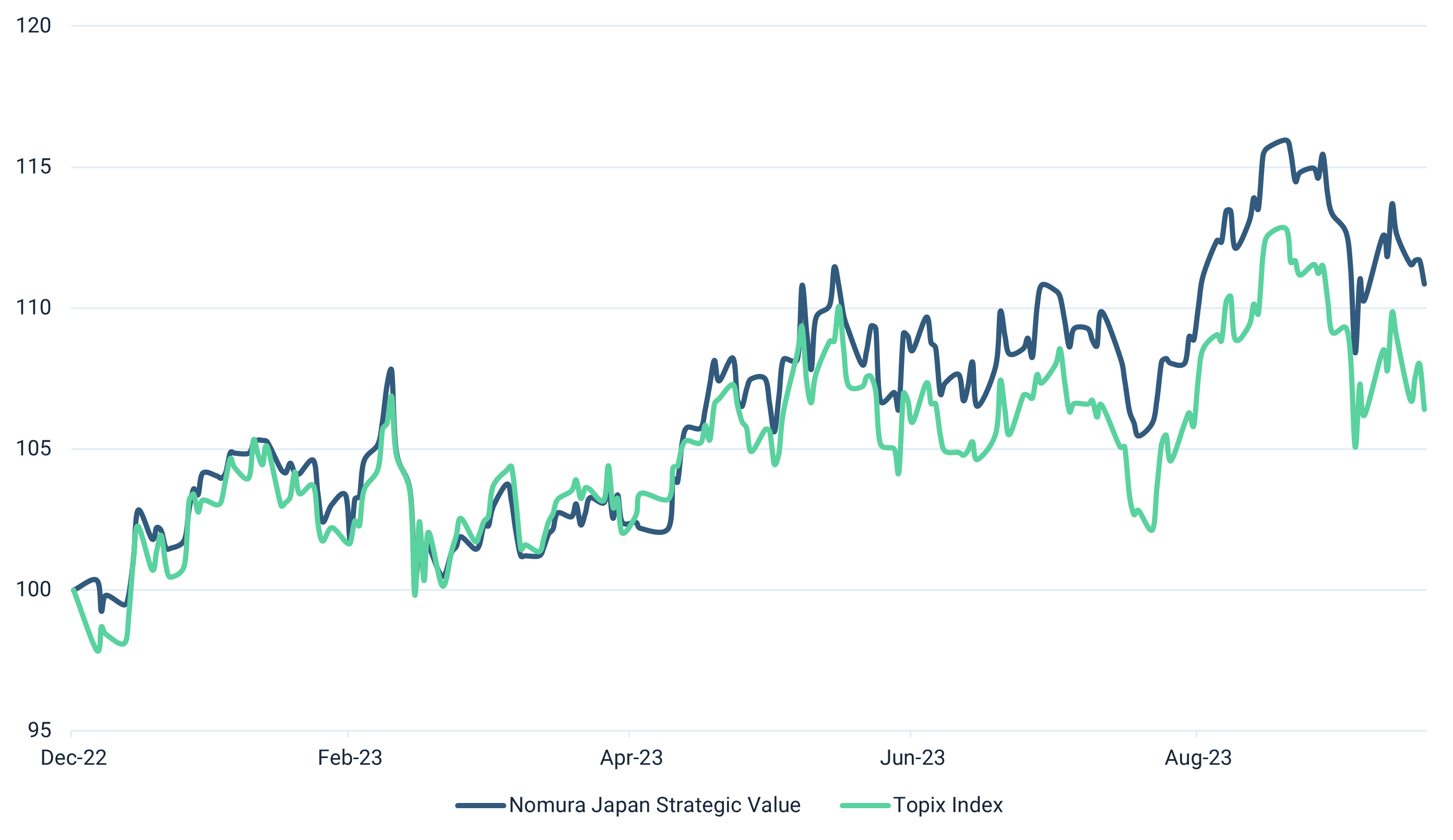

On a regional level, corporate earnings in the United States have just reached an all-time high, and analysts expect robust earnings growth next year. Earnings in the UK have been falling but analysts currently expect a small recovery next year. For developed markets, Japan is a standout performer for profitability, with corporate earnings expected to grow 10.5% this year, and 5.8% in 2024. Earnings within Emerging Markets have fallen this year, but analysts expect a strong recovery next year with +18.6% expected earnings growth for 2024.

The US stock market is the only major region that is meaningfully overvalued compared to history, investors are prepared to pay more for companies listed in the US in general, and especially for those expected to profit most from new technologies (e.g. artificial intelligence). The UK stock market is very cheap compared to history, trading about 30% more cheaply than its 10-year average (price to earnings ratio).

Assessing the value of different asset classes compared to historical patterns indicate that investors are now pricing in a lower probability of recession than they did earlier this year. However, many assets are still trading significantly more cheaply than others, for example smaller company stocks (especially the UK and mainland Europe), as well as many emerging and frontier markets.

Sentiment / flows

Stock market volatility has been fairly low all year, the widely followed VIX index has rarely edged above its long-term average of 21 throughout 2023. It increased from a low of 13 at the start of September to around 22 at the time of writing, reflecting some investor concern about the path ahead (but barely above its long-term average). Readings above 30 generally indicate fears of large drawdowns in stocks, so we are not there yet. Stock market momentum is pointing downwards in many markets as some investors have been reducing stock allocations, de-risking portfolios. Additionally, market breadth has been falling, and demand for insurance contracts (e.g., put options) on stocks has been increasing as more investors have been protecting against downwards movements.