Should you always buy local?

Many investors naturally lean towards what they know, favouring shares and bonds from their home market. This tendency – known as home bias – is a result of traditional beliefs that you will benefit from investing in a familiar market; one with the same currency, same time zone, same language, and companies that an investor has grown up with.[1]

Given the globalisation of capital markets that has taken place over the last few decades, none of these traditional beliefs hold true now. Indeed, for UK investors, home bias has come at a cost over the past decade. Buying local has often meant missing out on stronger returns elsewhere, particularly the US market.

At Saltus, one of the core tenets of our investment approach has been to avoid a home bias. We believe that a home bias leads to over-exposure to one market and therefore introduces unnecessary risk in portfolios. We have always had a global approach, which has increased diversification, and risk-adjusted returns.

Our portfolios currently have a neutral position in UK equities, in line with the global stock market. Given the UK stock market’s strong performance this year, and some potential tailwinds, we are considering our allocation here. In this article we explore whether these tailwinds are sustainable, or whether the UK market performance is sending false signals.

Value or illusion?

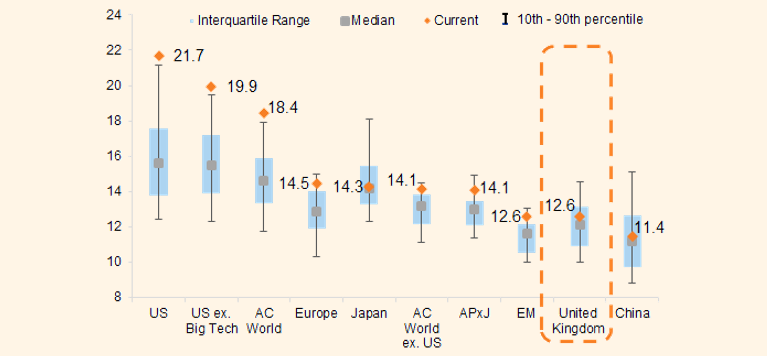

At first glance, the UK stock market, particularly the FTSE 100, appears to offer good value. Share prices are trading at relatively low levels compared to company earnings, dividend yields remain attractive, and investor sentiment has been subdued for some time. For many, this combination suggests a potential buying opportunity.

However, a closer look reveals a more complex picture. Beneath the surface, structural weaknesses in the UK economy, uncertain global conditions, and compressed valuations may be masking deeper risks. What seems like value may in fact be a value trap.

FTSE flying high

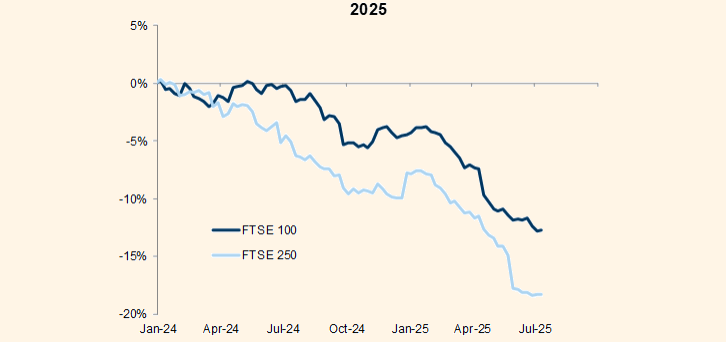

On 14th July 2025, the FTSE 100 broke through the 9,000 mark for the first time.[2] It then briefly touched an all-time high of 9,158 on 24th July 2025. Year to date, the index has risen by 10%, outpacing the S&P 500, which is up about 6.5% and 0.9% for a pound sterling investor.[3] [4]

This rally has been driven primarily by aerospace and defence companies, as well as financials. An early UK/US trade deal helped, as well as announced government reforms to boost investment in UK assets. There have also been questions over US exceptionalism (more can be read about this here: 2025: The story so far… | Saltus), so investors have redirected some of their capital back over the Atlantic.

Much of this strong performance has come from a handful of large, internationally focused companies. In fact, over 80% of revenues generated by FTSE 100 firms come from outside the UK. [5] This means the headline index is often more reflective of global trends than of the UK economy itself. As a result, while the FTSE 100 may look strong on the surface, it does not necessarily reflect the more fragile state of the domestic market. The next 250 largest companies represent a more accurate picture of the domestic market. The returns of these companies – the FTSE 250 – have been more modest, with a 5.5% gain during 2025 so far.[6]