Introduction

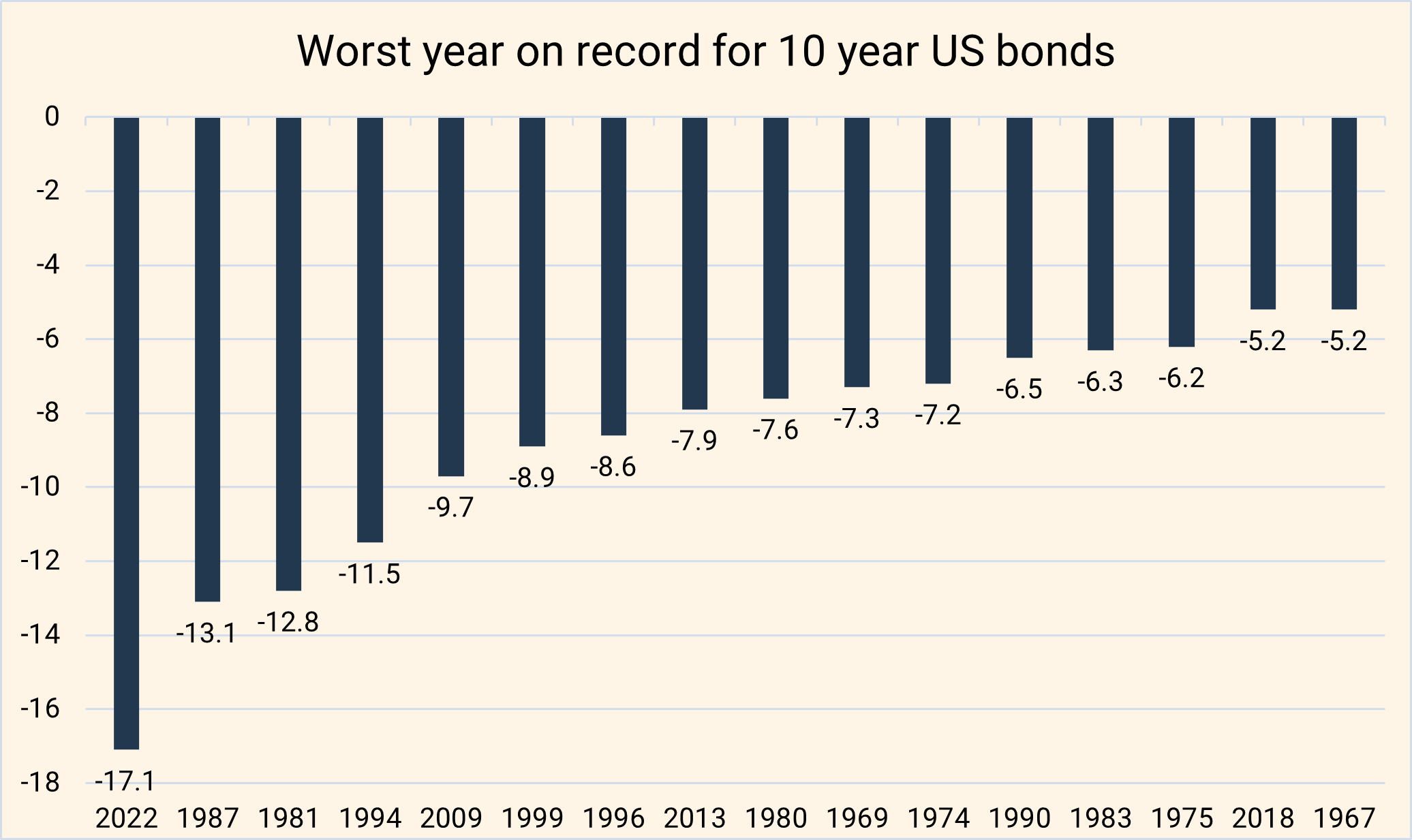

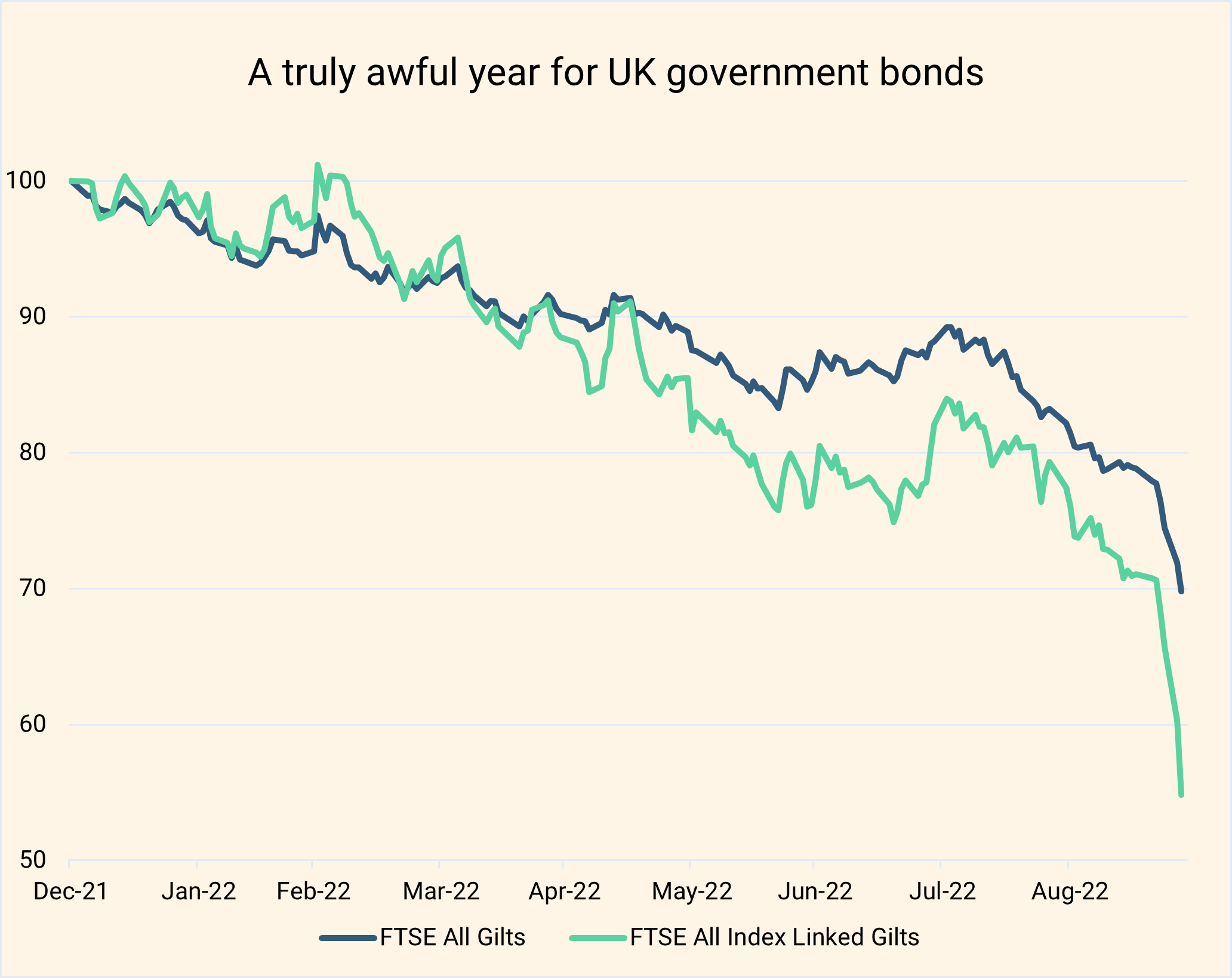

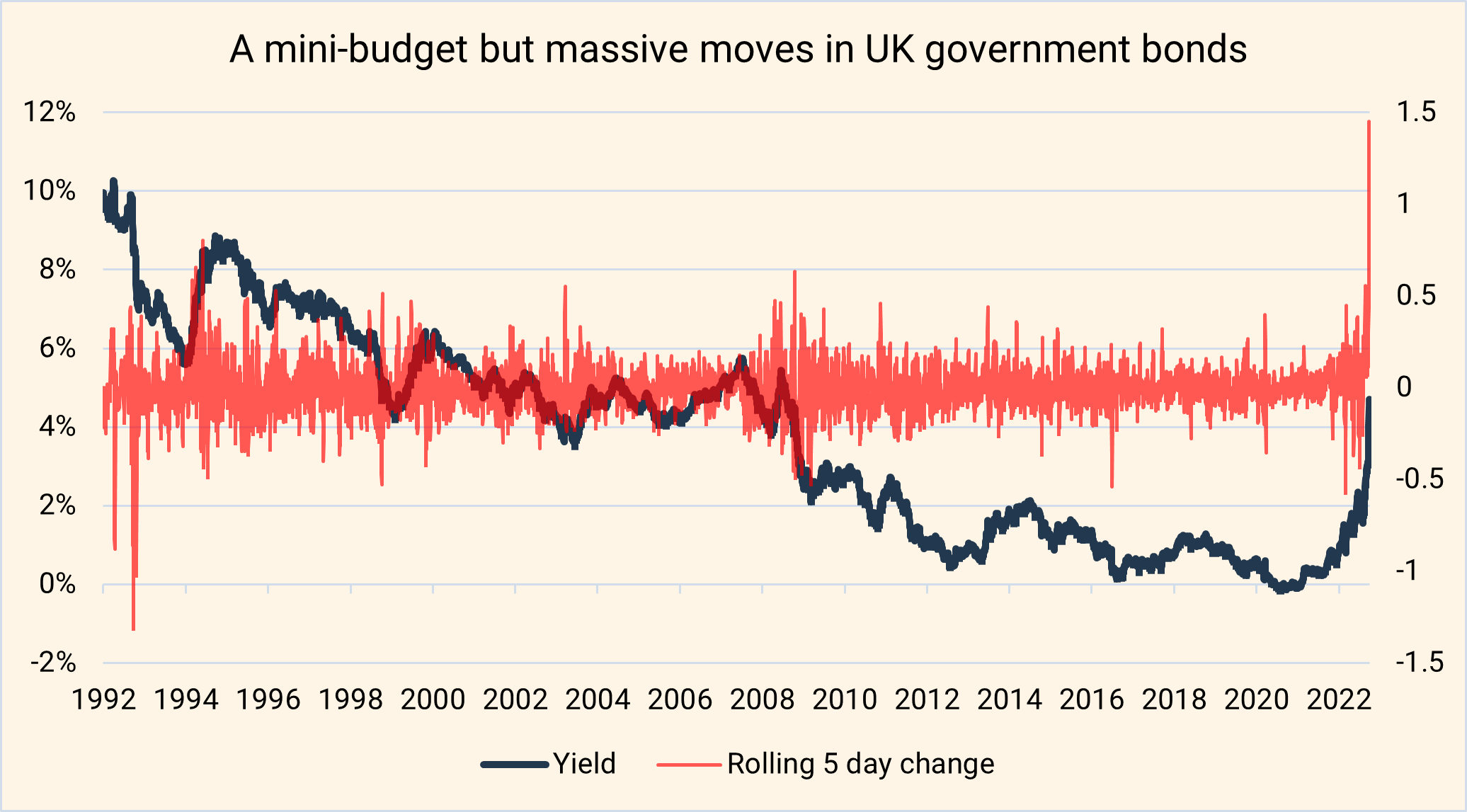

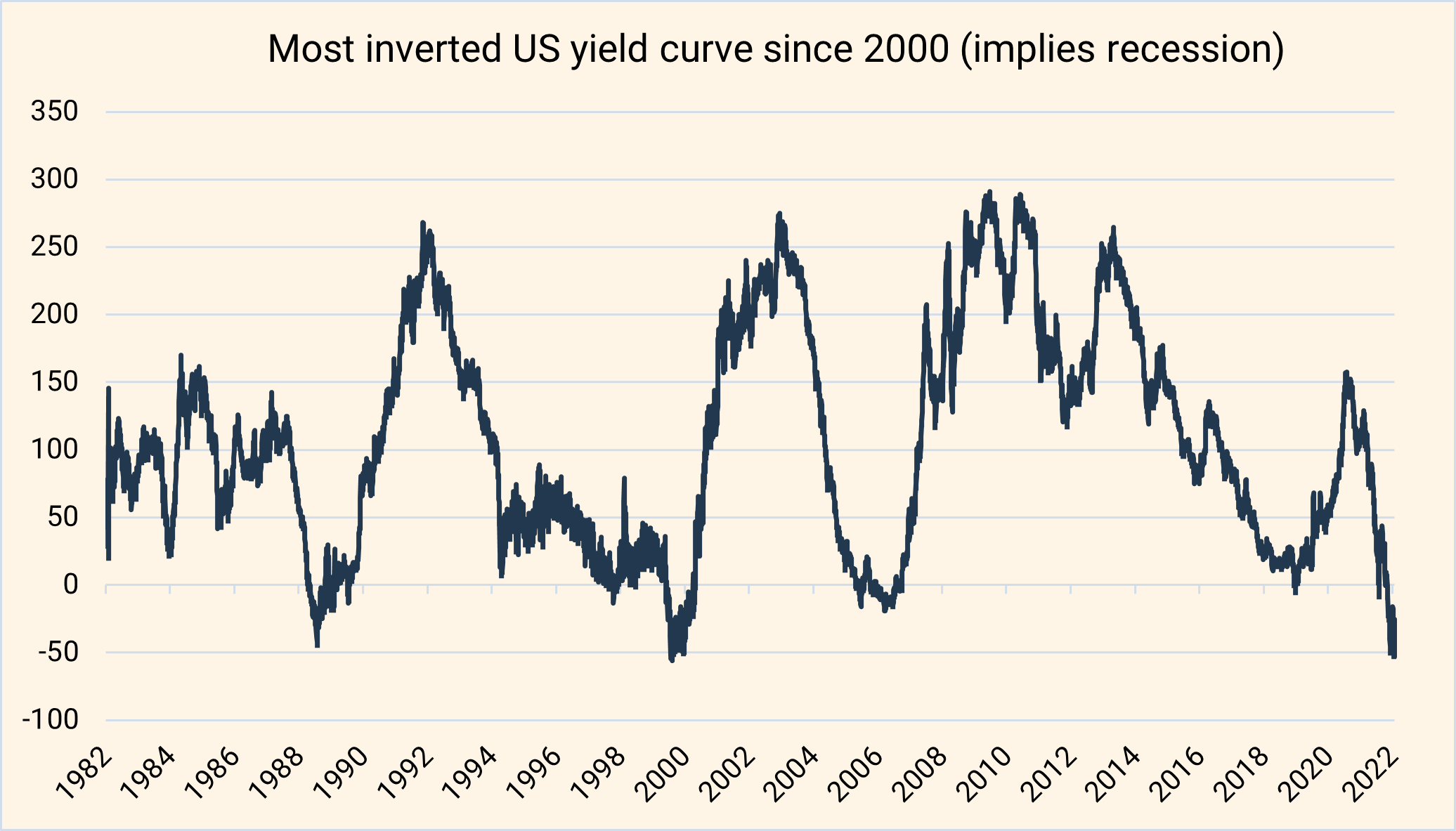

The bond market is huge, complex, and extremely important. Bonds are often viewed as the safest part of investment portfolios, relied on to provide protection when trouble arises. However, this year has been the worst start to a year for bonds in decades, with many of these “safe” investments down over 20% this year. So, what is going on with bonds, and what are Saltus doing about it?