The first quarter of the year hasn’t been without drama with major revisions being made to global GDP forecasts. The IMF is now predicting global growth of 2.8% for 2025, down 0.2% from our previous update.[1] The largest revision from the IMF has been to the US economy which forecasts a 1.8% growth down from 2.7% earlier this year. The IMF has predicted a 1.1% growth for the UK, 0.8% for the Euro area, 4.0% for China and 0.6% Japan.[2]

Inflation remains a problem for developed world economies with further structural issues coming into play for the UK. At the latest reading, headline consumer prices dropped to 2.4% in the US, 2.2% in the Eurozone, 2.6% in the UK, and 3.6% in Japan, all above central bank target levels. The current measures haven’t considered the impact of President Trump’s tariffs, and the UK forecasted for higher inflation throughout 2025 owing to the increase in consumer energy prices[3].

Unemployment is still near historic lows in the developed economies; however, there has been a slight uptick in both the US and UK with a 4.2% and 4.4% unemployment rate respectively. US and UK wage growth has remained healthy, which encourages consumer spending and thus demonstrating the resilience of the economy[4].

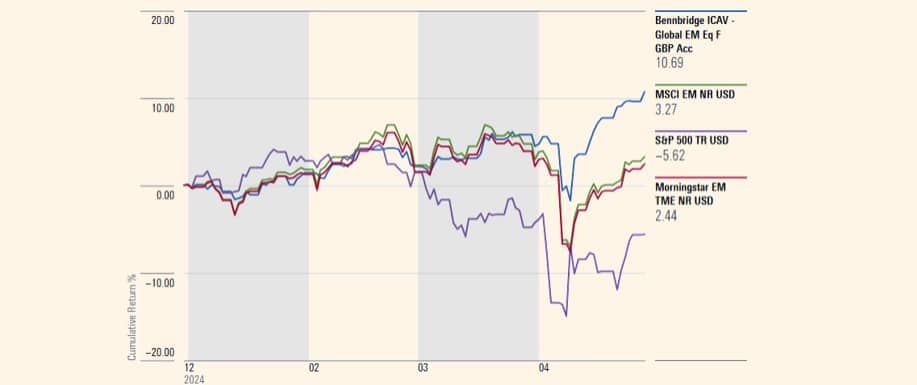

The first quarter earnings season for the S&P 500 is off to a slower start than usual, with fewer companies exceeding earnings expectations and the size of earnings surprises falling below of historical averages. So far, 12% of companies have reported results, with 71% beating earnings estimates, below the 5 and 10-year averages of 77% and 75%, respectively. While earnings are flat compared to the end of last quarter, the index is still showing year-over-year growth for the seventh consecutive quarter.[5]

In the world of monetary policy, the US Fed rate remains unchanged from the last meeting at 4.25% to 4.50%. The Bank of England maintained its policy rate at 4.5%, however, the European Central Bank cut their base rate by 0.25% at their most recent meetings, to 2.25%. The Bank of Japan rate remains unchanged from its hike earlier this year at 0.50%.[6] In the US, rate cuts are likely to remain on pause until the end of the year with a further 0.25% priced into the market for December. With the increasing uncertainty of Trump politics, central banks (the Fed in particular) are taking a more hawkish approach to policy rates amidst fears of higher inflation and potential recession.

Market Themes

Trump Tariffs

Less than three months into President Trump’s second term, the level of policy uncertainty has surpassed expectations laid out in our previous updates. While markets initially responded positively to the election results, optimism quickly faded amid the velocity and size of tariff announcements.

The administration’s evolving stance on trade, marked by inconsistent tariff policies, has introduced significant uncertainty for businesses and households alike. This environment is beginning to impact economic sentiment, with early signs of more cautious behaviour across both consumer and corporate sectors.

Further complicating the picture, the recently established Department for Government Efficiency (DOGE) has initiated large-scale reductions in federal employment. Though aimed at curbing governmental fraud and inefficiency, the execution of these cuts has raised wider concerns about the Trump administration’s policy stance.

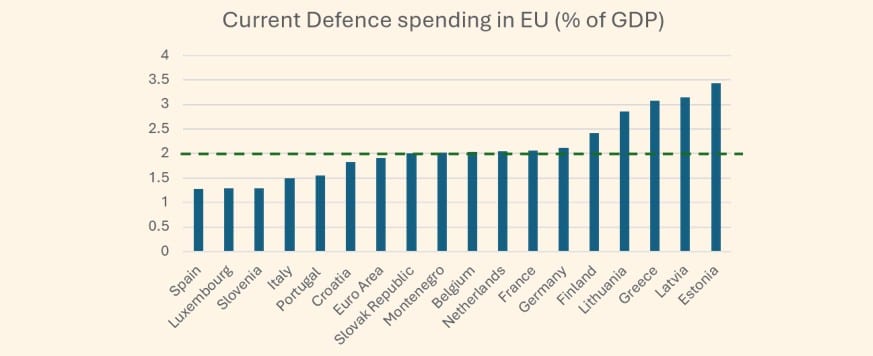

On the international stage, the US has signalled a shift in its traditional security commitments to Europe. In response, several European countries, led by Germany, are reassessing their defence strategies. The European Union has approved additional defence spending of up to €650 billion, alongside a further €150 billion in defence-related loans.[7]