A debate has been raging for some time. Should investors attempt to maximise their dividends and interest income? Or should they generate returns through both capital growth and income?

In this article, we try and put this debate to rest. We have two Saltus advisers giving their views, one looking at investment considerations and the other at financial planning considerations.

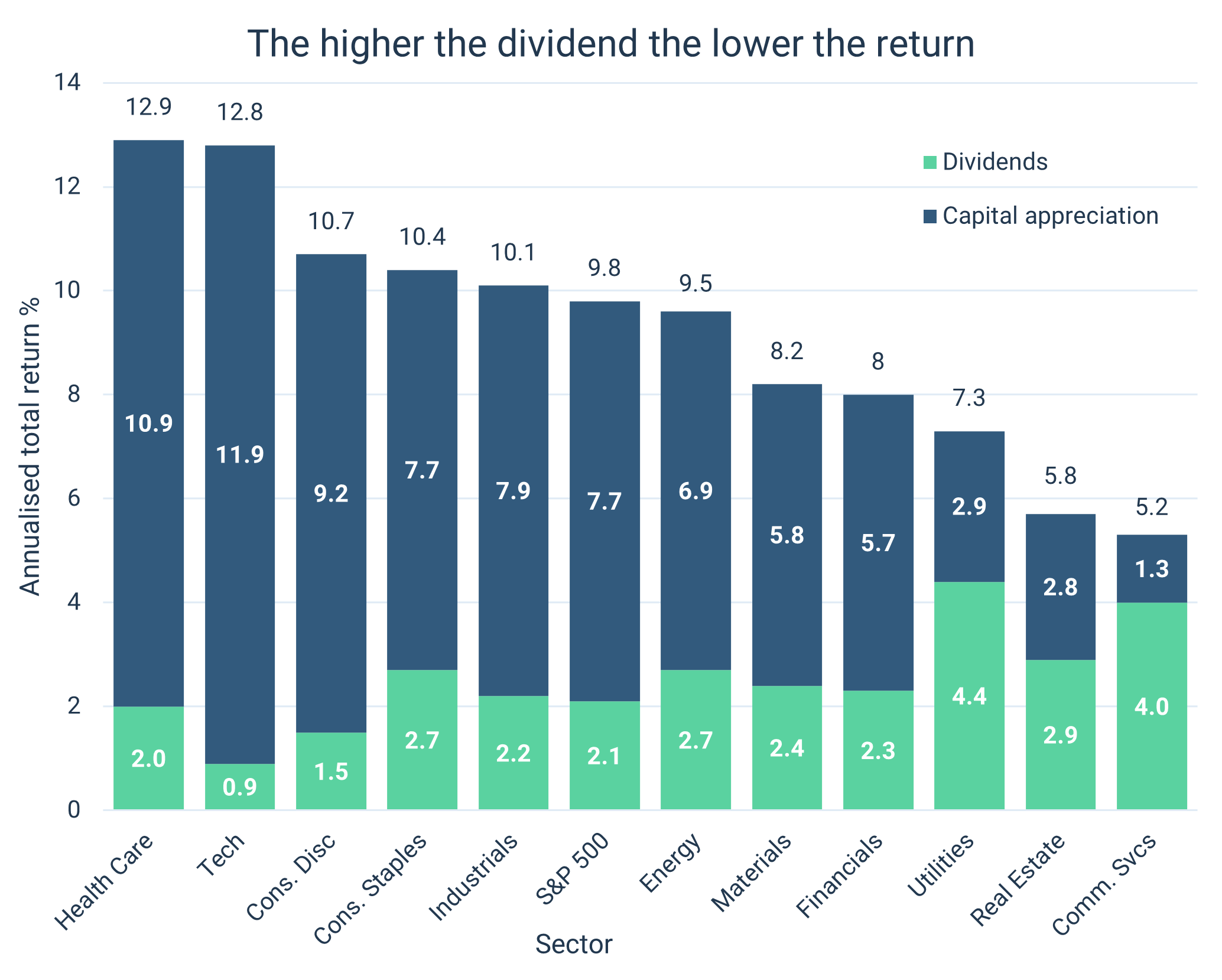

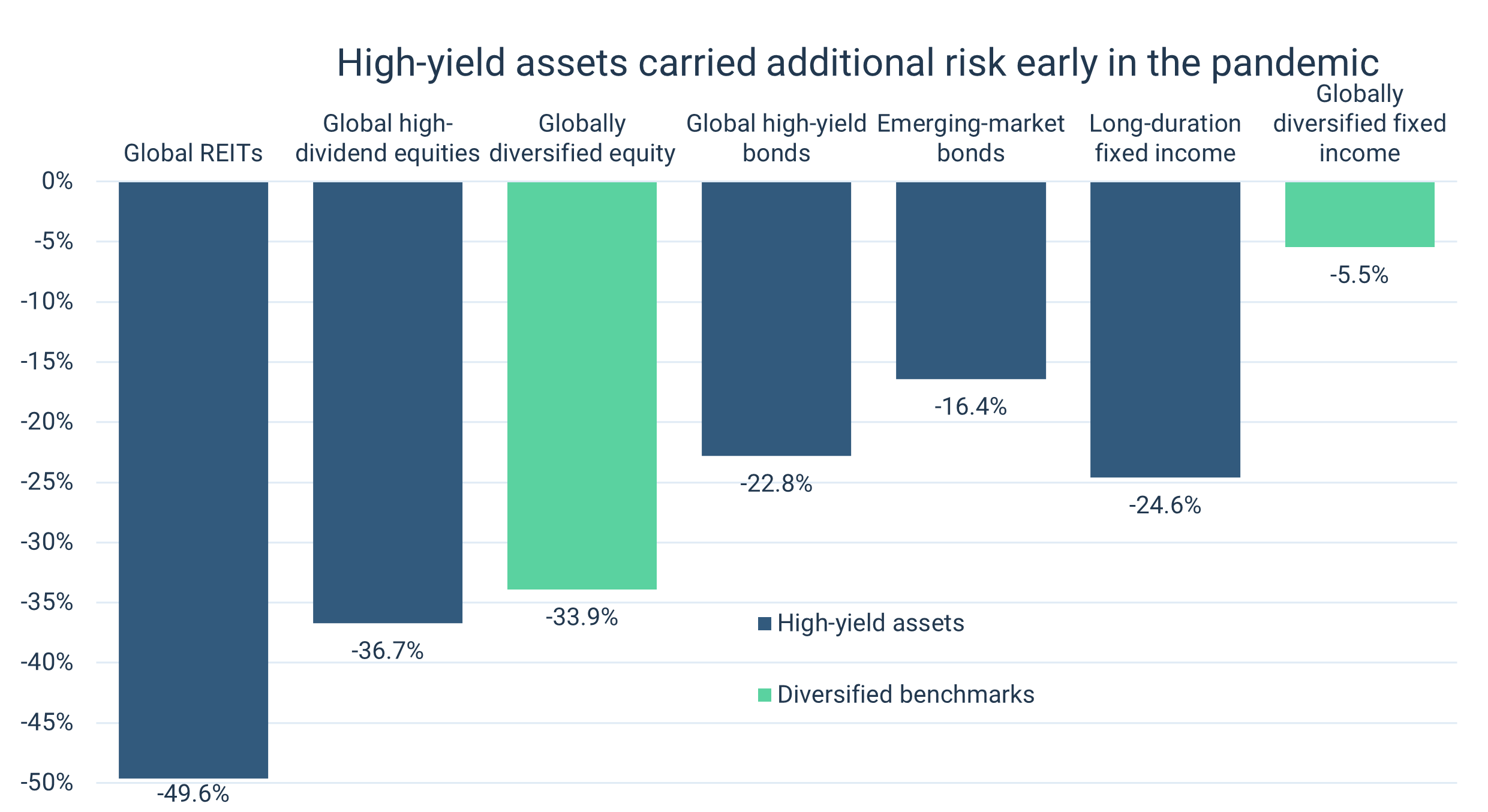

On the investment side, Saltus adviser Adam Long, makes the case that investing for natural income can present additional risks to more diversified approaches, whilst potentially reducing returns. To support his case, he uses analysis from the world’s most famous investor (Warren Buffett), his lesser-known British equivalent (Terry Smith), and the world’s second largest asset manager (Vanguard).

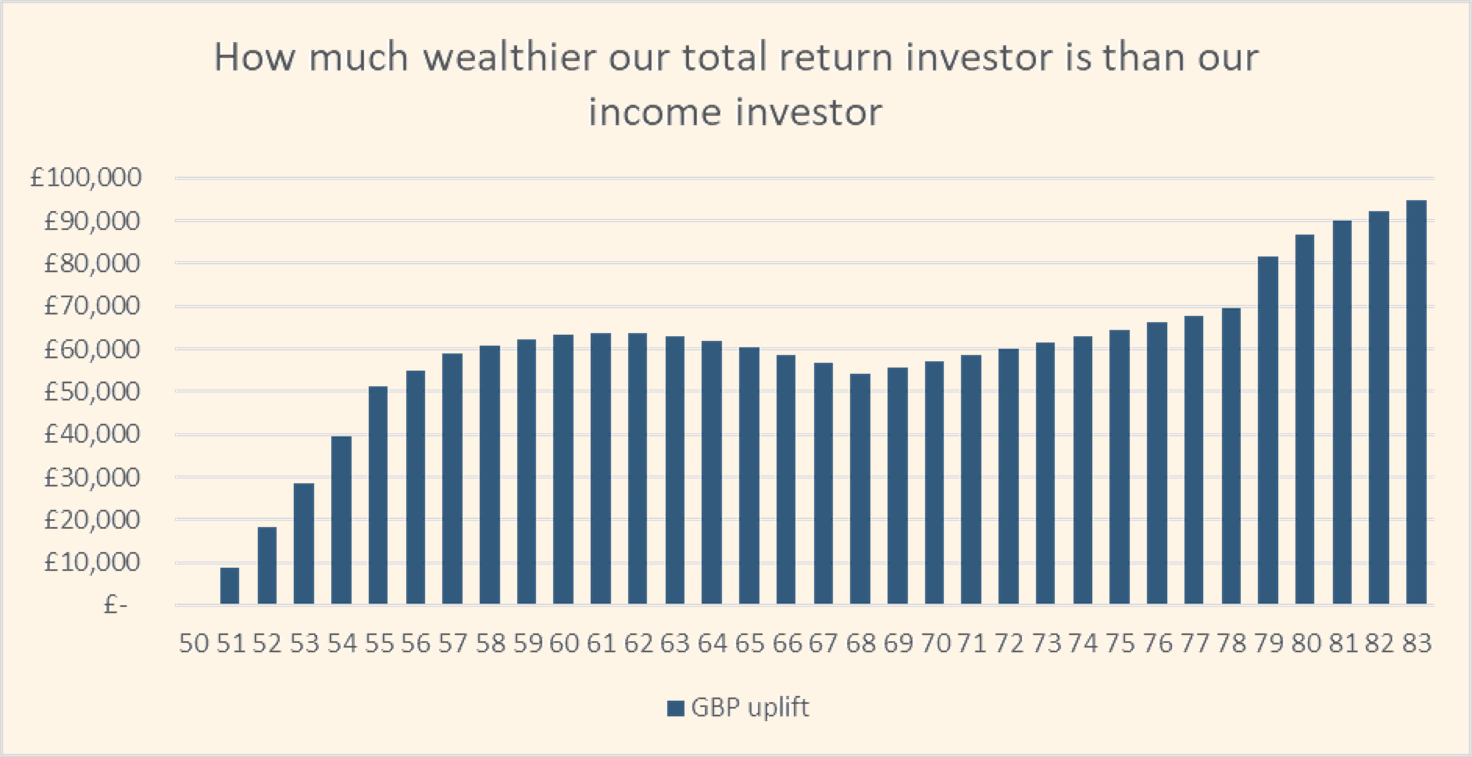

Jack Munday brings us up to date on the financial planning considerations of both approaches. He uses sophisticated cash-flow planning software to highlight some of the differences.

This article is for information purposes and should not be considered advice. Suitable selection of investments, and their tax treatment, depends upon individual circumstances and may be subject to change. If unsure, seek advice.