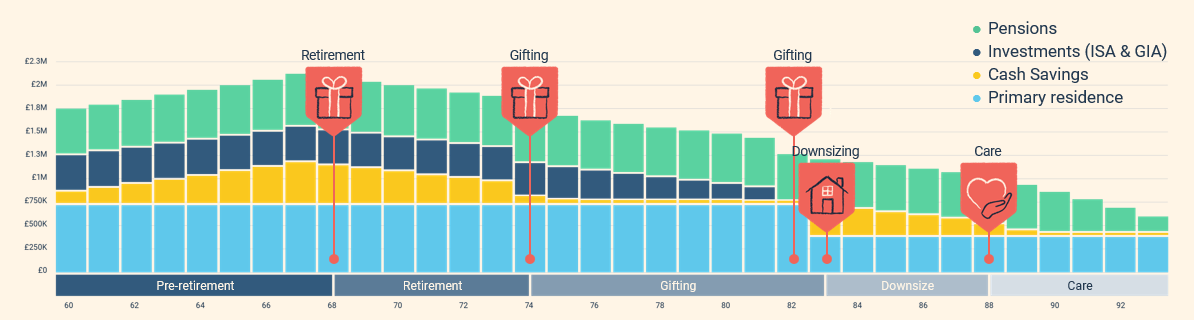

A cashflow plan has the potential to be life-changing. Most of us wouldn’t set out on a journey to somewhere we’ve never been before without plugging a postcode into our sat nav or relying on an app for directions. Why then would you even consider retiring without first mapping out your journey from A to B? As well as providing you with a concept as to whether your retirement will ultimately be a comfortable one, cashflow plans can help you to make vital decisions with your money.