How much do you need to retire comfortably? It’s one of the most frequent questions we are asked as advisers. The most common error though is that individuals are always looking for an estimated number to answer this question, without any consideration for their personal circumstances or expenditure levels. This, of course, is a fool’s errand as a ‘comfortable’ retirement is likely to vary substantially from one individual to another.

How to define a ‘comfortable retirement’

Numerous bodies have attempted to provide some guidance around the level of income that might be required for retirement. The Pensions and Lifetime Savings Association (PLSA) and the University of Loughborough carried out extensive UK based research. They concluded that a single individual requires £43,900 per annum and a couple require £60,600 a year for a ‘comfortable’ retirement.[1]

They define a comfortable retirement as “a lifestyle that allows more spontaneity, including extra-long weekends away in the UK, some day trips, extra spending allowance on eating out, and social activities.”[2]

You may have had a few more aspirational things on your mind when planning your ‘comfortable’ retirement. Well, we also surveyed over a thousand individuals who had more than £250,000 in investments in our annual Saltus Wealth Index: 60% of respondents believed they would need more than £50,000 a year in retirement (regardless of their marital status), and over 20% believed they would need over £70,000 a year to maintain their standard of living.[3]

The reality is that everyone is different and all research pieces tend to come up with varying conclusions. A far superior approach is to take time with an adviser to analyse what you spend now, and how this may change in retirement – a bespoke plan can then be built around your personal needs.

How much should you have invested when you retire?

The 4% rule is famous the world over. It was formulated by economist William Bengen, and he determined that, regardless of when someone retires over a 50 year period, their pot will always last 30 years if withdrawals are maintained at 4%.[4]

To make use of this rule, first you should check if you’re eligible for a full state pension. You can find this out by going on Gov.uk and viewing your National Insurance record.[5] If you’ve made roughly 35 years of National Insurance contributions, most people will receive just over £11,973 p.a. at state retirement age and it should increase with inflation (hopefully) for the foreseeable future.[6] The remaining income you require (shortfall) over and above your state pension can then be divided by 4% to provide a very rough estimate of the pot you might need:

How much does a single person need to retire:

| Individual Desired Income | State Pension | Shortfall | Pot required |

|---|---|---|---|

| £43,900 (PLSA 'comfortable' retirement) | £11,973 | £31,927 | £798,175 |

| £60,000 | £11,973 | £48,027 | £1,200,675 |

| £80,000 | £11,973 | £68,027 | £1,700,675 |

| £100,000 | £11,973 | £88,027 | £2,200,675 |

How much does a couple need to retire:

| Couple Desired Income | State Pension | Shortfall | Pot required |

|---|---|---|---|

| £60,600 (PLSA ‘comfortable’ retirement) | £23,946 | £36,654 | £916,350 |

| £70,000 | £23,946 | £46,054 | £1,151,350 |

| £80,000 | £23,946 | £56,054 | £1,401,350 |

| £100,000 | £23,946 | £76,054 | £1,901,350 |

Do you need help with your retirement planning?

Our specialists can help you prepare for retirement and provide ongoing advice once retirement has arrived. Get in touch to discuss how we can help you.

A couple with full state pensions, who want to take around £70,000 a year in retirement, will need a pot of over £1 million and a single person looking to achieve £60,000, will need over £1.2 million. Although, it’s vital to remember that these numbers are gross of tax. If they haven’t structured their assets effectively to reduce their tax position in retirement, a couple will probably need closer to £1.5 million to achieve the same £70,000 net a year. Time will also have an impact as the calculation only applies for 30 years. If you want to retire at 55, you’re going to need significantly more in addition to the above figures to ensure your pot lasts until death.

There are some major flaws with Bengen’s method though:

- It doesn’t consider future return rates

- Although it does allow for inflation, withdrawals could well be for longer than 30 years. Bengen himself has also noted it’s weakness due to its inflexibility and more recent inflationary pressures

- It takes all asset classes into account in all scenarios – results would differ greatly for 100% equity portfolios

- It relies on withdrawal rates being consistent

- It assesses markets up to 1976, not accounting for modern market reactions and global changes

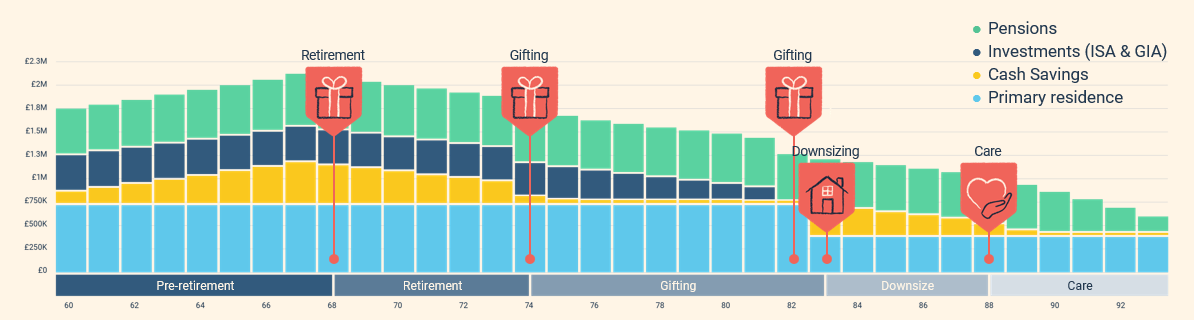

The importance of cashflow planning in retirement

The best method for determining exactly how much you need to invest for retirement is by having a bespoke cash flow plan created. This can take into consideration variable withdrawals and capital expenditures you plan to make as well as allow for a range of market returns by stress testing assumptions.[7] Furthermore, it can prove helpful for scenario planning where you, for example, compare ‘Model A’ to ‘Model B’ to help you make informed financial decisions such as retiring at 60 compared to retiring at 65. It’s also worth repeating how vital tax-efficiency will be in achieving a comfortable retirement. This is something that will be a significant feature of a detailed cashflow model. Structuring your assets in a tax-efficient way could quite literally reduce your required pot size by hundreds of thousands.

A simple version might look something like this:

So, how much do you need to comfortably retire? Have a cash flow plan made to find out. Rules of thumb and estimates are helpful to get you started but, really, they can’t be relied upon. If this is a question that’s been giving you some concern, it’s probably time to take some advice.

Do you need help with your retirement planning?

Our specialists can help you prepare for retirement and provide ongoing advice once retirement has arrived. Get in touch to discuss how we can help you.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

Saltus Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

About Saltus?

Find out more about our award-winning wealth management services…

Shortlisted

Wealth Management Company of the Year (£10bn+ AUM)

Nominated

Good Money Guide Investment Awards 2026

Winner

Top 100 Financial Advisers

Winner

Best Wealth Manager

£10.4bn+

assets under advice

20

years working with clients

450+

employees

97%

client retention rate