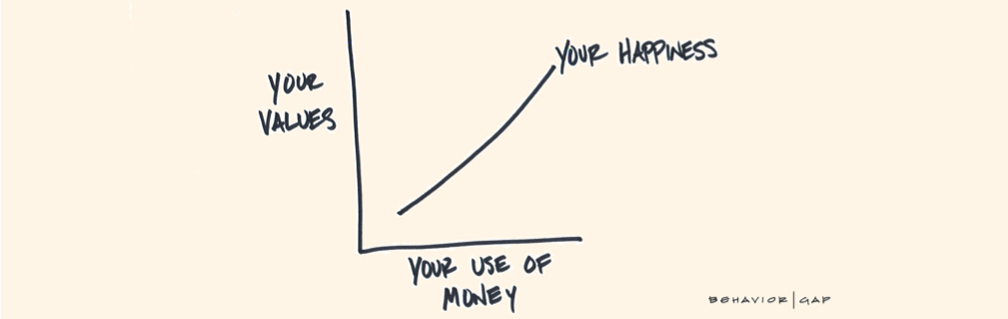

Let us begin by exploring the term ‘wellbeing’, financial wellbeing being a subset of this much larger topic. Unfortunately, the term has become slightly clichéd: a catch all for all manner of tenuously linked ideas and the current zeitgeist of marketing. Whenever I see a high street bank or a financial institution using the term, it always makes me cringe. The irony that I’m writing from within this sphere is not lost on me!

In the context of this piece, I’m using wellbeing as a proxy to describe the overall level of happiness and satisfaction you have in your life. Sounds simple, but with the challenges of modern life, less so in practice.

Research indicates that the following areas make up the currency of a ‘life that matters’. They do not include every nuance of what’s important, but they do represent the five broad categories that have meaning to most people.