Global growth remains robust, with positive GDP growth rates across the board in Q3. Again, the US leads the way from a strong growth and low unemployment perspective. China’s GDP growth remains positive, but it is running well below the government’s target of 5% for 2024 as a whole.

Globally inflation rates, whilst still low, are picking back up. At the latest reading, US inflation increased from 2.6% to 2.7%, 2% to 2.3% in the Eurozone, and 1.7% to 2.3% in the UK. Although still at relatively low levels, these growing numbers highlight the difficulty of ‘the last mile’ in terms of seeing inflation sustainably at or below target levels.

Unemployment remains near historic lows in the developed economies. This is supporting healthy wage growth, which combined with lower inflation is bolstering the consumer by increasing purchasing power. A buoyant consumer has been a key pillar of economic growth and earnings growth in this cycle.

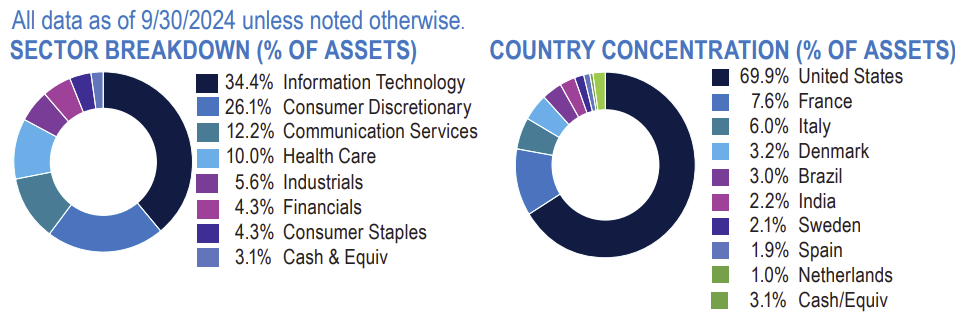

Third quarter earnings mirrored the economic growth picture. US earnings were robust, with revenue and earnings growth beating expectations. It was a more muted story in Europe and the UK, with positive and negative surprises offsetting each other. Global earnings growth is set to be near 10% in 2024 as a whole, rising to 12.3% in 2025, with the US and Emerging Markets (EM) being the bright spots at 14.3% and 14.5% respectively. The UK and Europe are the laggards, with 6.2% and 7.8% expected earnings growth for 2025. This is reflected in valuations with the US being overvalued relative to its long term average, and the UK and Europe looking undervalued.

Central banks continue their rate cutting path. The US Fed, the Bank of England and the European Central Bank (ECB) all cut their base rate by 0.25% at their most recent meetings, to 4.75% (upper band), 4.75%, and 3.0% respectively. In the US, expectations for rate cuts in 2025 have been tempered following the presidential election.

Market Themes

Trump Returns

November was dominated by the US presidential election and the resultant clean sweep for Donald Trump. Since then, investors have been trying to foresee the impacts this will have on financial markets. The consensus is for Trump’s ‘America-First’ agenda to target lower taxation, deregulation, trade tariffs and lower energy prices, with a view to bringing more manufacturing and industrial activity back onshore. His main messages during the election campaign were to put an end to inflation, and grow the economy, and he has made reference to the US stock market as a gauge of his success.

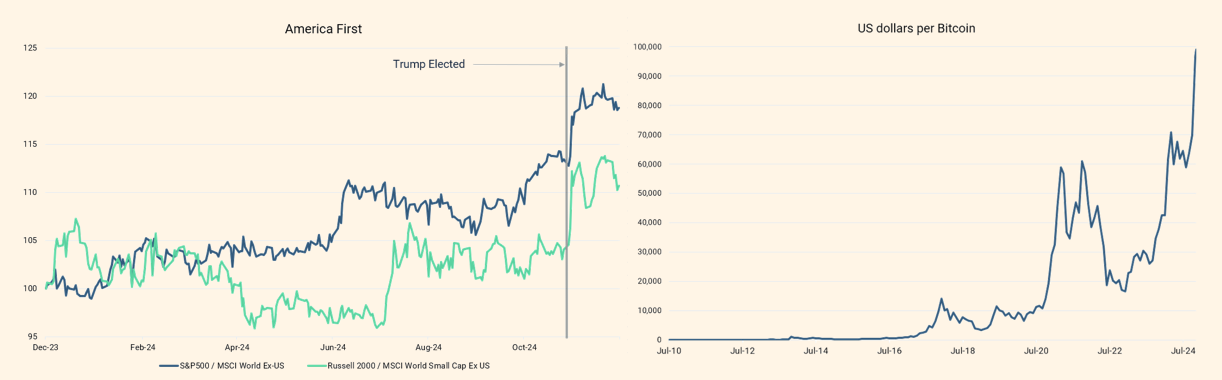

In the month since the election, one of the main beneficiaries has been US stocks, and especially smaller US companies given their greater domestic focus, meaning they should benefit more from tax cuts and reshoring of production. The blue line in the first chart below shows the performance of the US stock market relative to the global stock market excluding the US. The green line shows the US small companies index relative to the global small companies index excluding the US. We have marked the election date on there. The other beneficiary has been Bitcoin, which recently surpassed $100,000 for the first time. Trump has expressed support for the cryptocurrency market and has picked a crypto advocate – Paul Atkins – to head up the US Securities & Exchange Commission.