The Sage of Omaha and Mrs Watanabe are two names not typically associated with each other. However, Warren Buffett and the symbolic Japanese retail investor are both causing a stir in Japan with their actions and opinions as Japan has moved to the forefront of investors’ minds.

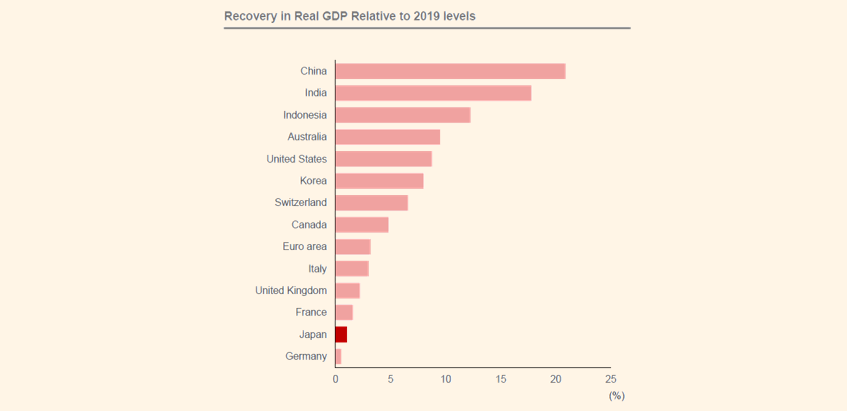

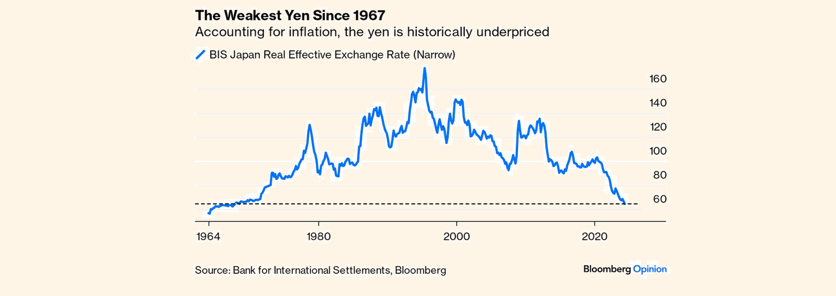

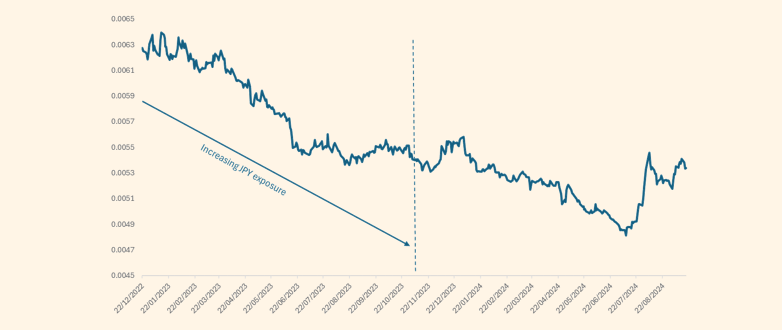

The fourth largest economy in the world is undergoing generational shifts in momentum. The central bank – the Bank of Japan (BoJ) – having pioneered ultra-loose monetary policy is now tightening policy whilst the rest of the world starts to loosen theirs. The currency – the Japanese yen – has weakened to levels not seen since the 1960s. Inflation has returned to the national psyche following a three-decade hiatus. And the stock market has been one of the standout performers of the last two years having spent a number of years going nowhere. Add in political upheaval, a rapidly ageing population, regional geopolitics, and corporate reform, and you have a mixed picture full of opportunities and risks.

In this article we will explore the drivers of these changes, as well as some of the opportunities and risks that investors should be aware of.