The last week has seen an exceptional level of turbulence in markets, particularly in the UK. Below we try to explain the background to events and our interpretation.

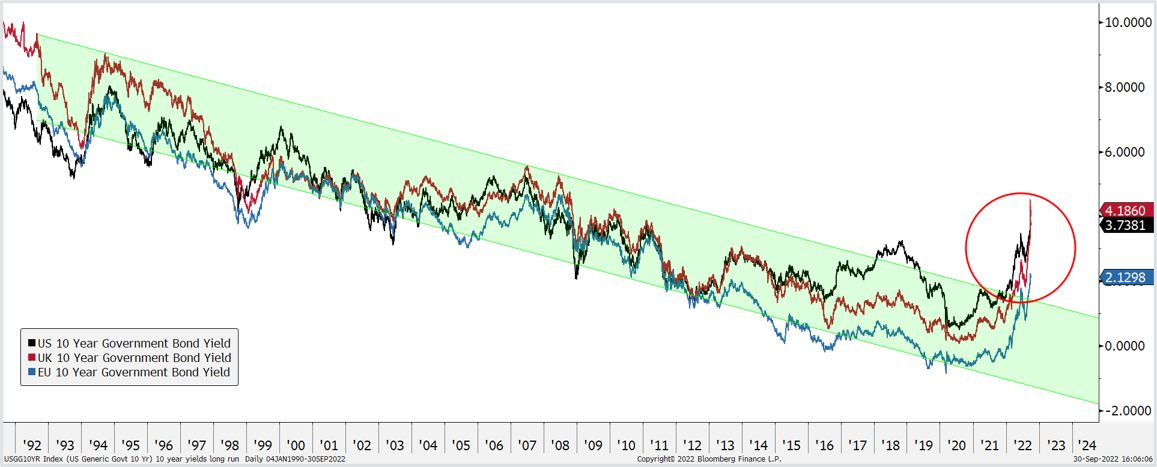

1.The global market is volatile – it’s not just the UK. This summer something important happened in world markets. The combined impacts of Covid and the energy shock from the war in Ukraine have driven inflation rates up to unforeseen levels in the developed world. This has forced central banks to sharply increase interest rates to slow demand and try to force inflation back down. By the summer of this year the ‘low inflation low interest rate’ world we had been used to for 30 + years had vanished, giving way to a new era of high inflation and higher interest rates. The graph below shows this shift into a new investment regime neatly. It plots the market benchmark borrowing rate for the US, UK and European governments since the 1990s. We can see quite clearly that a multi decade trend of falling interest rates has been decisively broken this year. We are now moving into a new era of higher inflation and higher interest rates and the transition is proving to be very bumpy.