As we approach the midpoint of 2025, the geopolitical, economic and financial market landscape has undergone seismic shifts, with potentially far-reaching implications for investors. In this article, we focus on some of these changes and suggest how investors can chart a course through these shifts.

The Three ‘T’s

Trump, tariffs, turmoil. If we only had three words to sum up the first five months of 2025, these would do a pretty good job. Trump’s whirlwind of tariff announcements since his inauguration in January have been an almost constant feature on newsreels. Since ‘Liberation Day’ on 2nd April, when Trump stunned the world from the quaint setting of the White House Rose Garden, the average global tariff rate has been in a state of flux.

Rather than list all the tariff announcements thus far (which would instantly go out of date anyway), what we can say with confidence is that the average global tariff rate is, and will continue to be, higher than it was at the start of 2025. Tariffs are essentially a tax on consumption, and so the expectation is that consumption will slow as a result, supply chains will gum up, trade activity will slow, and eventually the economy will too. These are the first order effects.

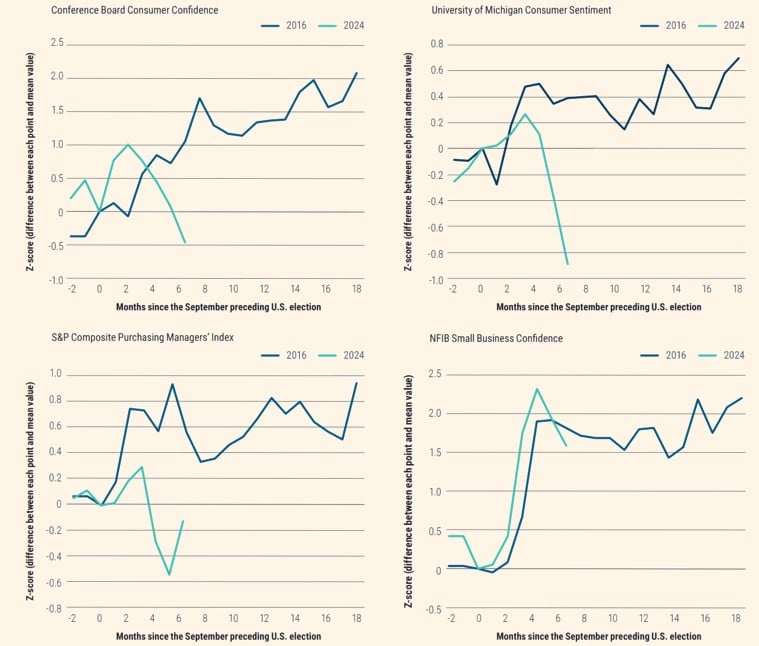

The second order effects stem from the uncertainty that these sporadic and disjointed announcements cause. We are hearing from more and more businesses that they are putting off hiring and investment decisions as it is impossible to make long term business forecasts in this environment. US business and consumer sentiment surveys have fallen off a cliff [1]. Even if some or all of the announced tariffs were rolled back, it is likely the uncertainty has already done enough damage to sentiment, and unless businesses indicate they will start investing again, and the economic data holds up, it is likely there will be a slowdown in the months to come.