The last quarter of 2024 was generally positive from an economic growth perspective, closing out a positive year overall. Of the major economies to publish 2024 GDP growth data, the US grew 2.8% in 2024, the UK 0.9%, the Eurozone 0.7% and China at 5%. Germany was a noticeable underperformer, finishing the year with -0.2% growth. The IMF predicts global growth of 3% for 2025. Breaking this down sees forecasts for the US of 2.7% growth, China 4.6%, the Eurozone 1%, Japan 1.1%, and the UK 1.6%.

Inflation remains stubborn in most major regions except China. At the latest reading, headline consumer prices rose 3.0% in the US, 2.5% in the Eurozone, 2.5% in the UK, and 3.6% in Japan, all above central bank target levels. China is still flirting with deflation, with a 0.5% inflation reading for January 2025.

Unemployment is still near historic lows in the developed economies. This is supporting healthy wage growth, which is bolstering the consumer. A buoyant consumer has been a key pillar of economic growth and earnings growth in this cycle.

Fourth quarter earnings season has been robust, with companies continuing to see positive sales and earnings growth, and margin expansion. Global earnings growth is set to be near 10% in 2024 as a whole, rising to 12% in 2025, with the US and Emerging Markets being the bright spots at 12.0% and 18.9% respectively. The UK and Europe are the laggards, with 7.0% and 8.8% expected earnings growth for 2025. This is reflected in valuations with the US being overvalued relative to its long term average, and the UK and Europe looking undervalued.

There is a mixed picture in central bank interest rate policy. The US Fed paused their rate cutting journey at the most recent meeting. The Bank of England and the European Central Bank cut their base rate by 0.25% at their most recent meetings, to 4.5%, and 2.75% respectively. The Bank of Japan hiked rates to 0.5% at their latest meeting. In the US, expectations for rate cuts in 2025 have been tempered. Apart from Japan, central banks are still generally moving in a lower rate direction, but are proceeding more slowly given the heightened uncertainty around growth and inflation in 2025.

Market Themes

Tariff Man

Donald Trump’s second term has got off to an eventful start. Not only did he sign more executive orders in his first 10 days than any recent president did in their first 100 days, but he has also fired the starting gun on multiple trade wars. On Saturday 1st February, Trump issued an executive order applying additional tariffs of 25% to all imports from Canada and Mexico, with the exception of Canadian oil and energy products, which faced a 10% levy. He also applied an additional 10% levy over and above existing tariffs on imports from China. By Monday 3rd February, following discussions with Canada and Mexico, he decided to put these on hold for 30 days. The China tariffs still stood though, and China retaliated in a limited manner so as not to escalate the situation. Trump then built on this on 9th February by announcing 25% tariffs on all US imports of steel and aluminium, widening the net of his protectionist agenda.

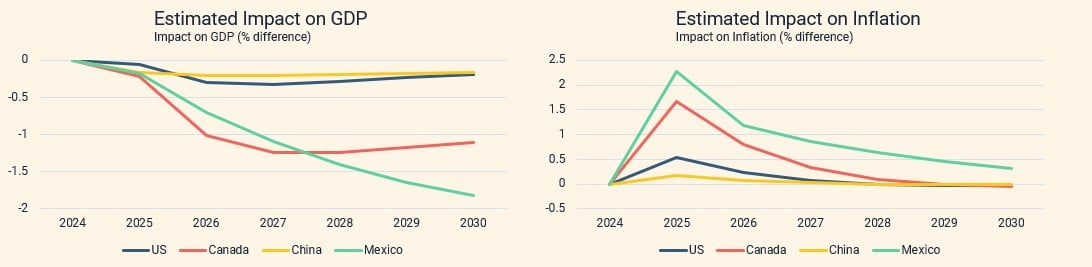

The US should be relatively unaffected because it is a closed economy and its trade with Canada, Mexico and China make up a tiny part of US GDP (2.8%, 2.9%, and 2% respectively). However, Canada and Mexico are much more exposed, with 34.2% and 42.5% of their GDP coming from trade with the US respectively. The charts below show the estimated impact on economic growth and inflation in the four countries from a simulated 25% tariff on Canada and Mexico, an additional 10% on China, plus reciprocal retaliatory measures. The tariffs announced so far have a far more meaningful impact (if imposed) on Canada and Mexico than they do on the US or China. These forecasts are open to a huge amount of uncertainty, for example, will the tariffs even be imposed, how long will they be imposed for, and will attention shift to the EU. Even when a decision is taken, we have seen how quickly it can be reversed.

There is no consistent motivation or objective for these actions. We don’t know whether the aim is to raise revenue, rebalance trade, improve national security, or to act as negotiating tools. There is no such thing as certainty under a Trump presidency, which makes it difficult to make predictions. What we can be sure of though, is that more economic uncertainty results in more volatility. We believe it is sensible to position for a more volatile environment.