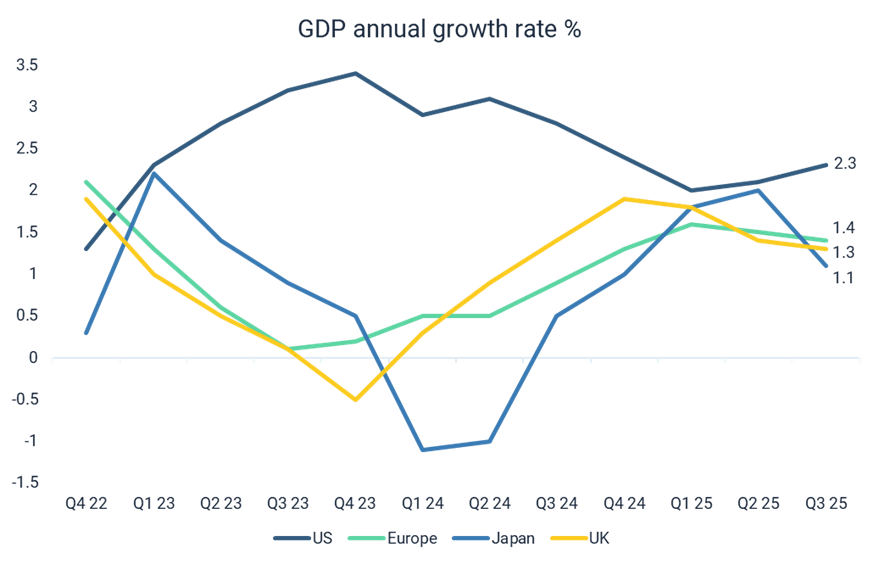

Global growth proved more resilient in 2025 than many expected. While real GDP growth across most developed markets fell slightly short of long term targets, the outcome was still respectable given the backdrop of a deteriorating geopolitical landscape, rising trade barriers, and a series of policy shocks that made forecasting unusually difficult.

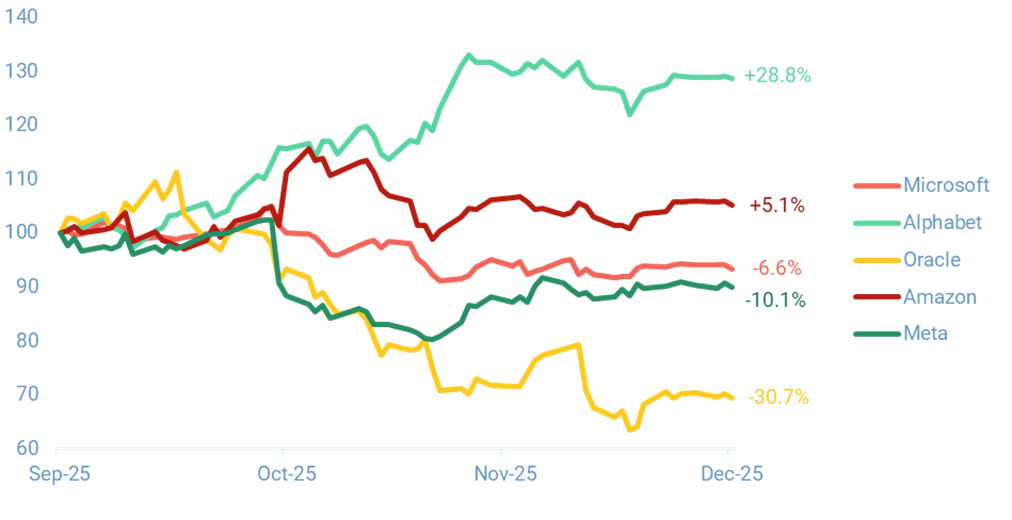

The US was the outlier in delivering growth slightly ahead of target and trending upwards. Much of this was driven by a surge in capital investment, particularly in data centres and AI‑related infrastructure, which has become one of the defining economic themes of this cycle.

Despite the resilience we’ve seen, looking forward, we are wary that the impact of changing global order has yet to flow through to real economies, reflected in consensus forecasts now pointing to a moderation in real GDP growth during 2026.