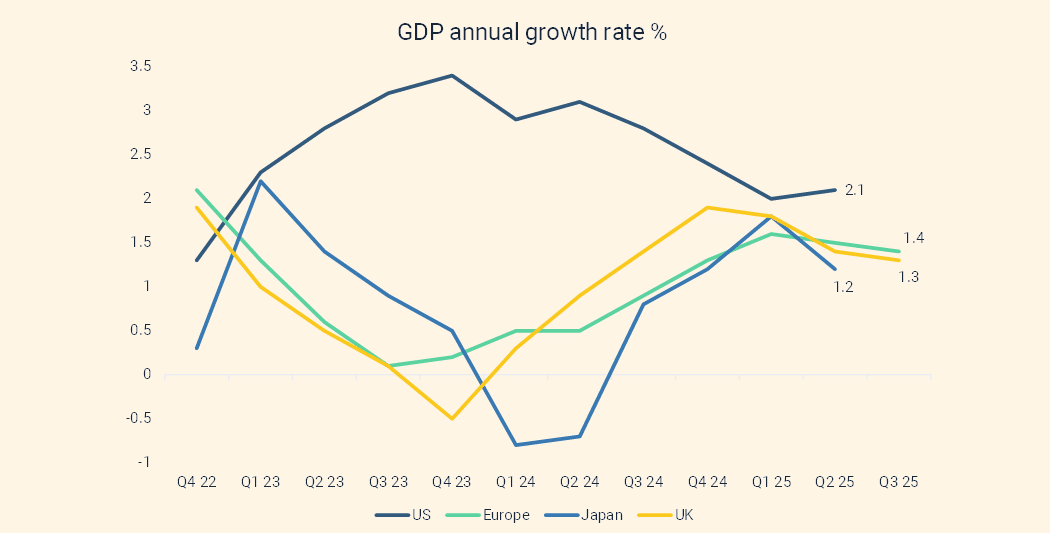

The major economies continue to see positive economic growth, however, growth rates are slowing.[1] In the US, economic growth has exceeded expectations, with little negative impact from Trump’s tariffs evident so far.[2] Capital spending on data centres to enable AI models has driven a significant proportion of the growth. Following the longest US government shutdown in history, some key economic data for September and October is missing which makes forecasts difficult. In the other major developed economies, growth rates are slowing, having recovered through 2024. Expectations are for a continuation of this trend – slowing GDP growth, but not to recessionary levels.[3]

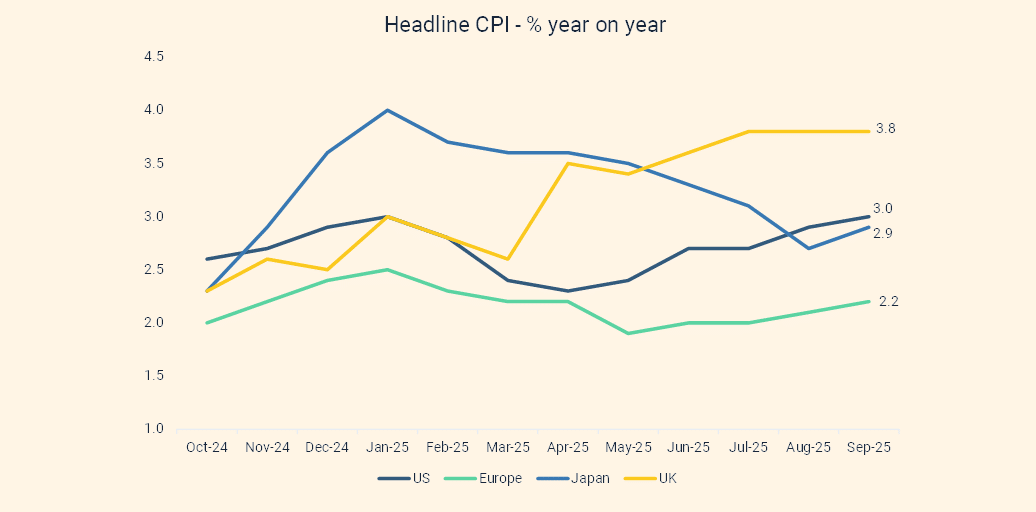

The picture is mixed on inflation. Headline CPI has been rising for the last four months in the US and is forecast to be over 3% by the end of 2025. Tariffs are expected to send inflation higher in the short term, but the impact should be temporary. The UK is also experiencing sticky inflation. UK headline CPI is almost twice the Bank of England’s 2% target. In Europe, inflation has been hovering around target for the last few months but has slowly started to move up again as we move towards the end of the year. Japan has had a much-needed reduction in inflation, and China is still battling with outright deflation.