Executive summary

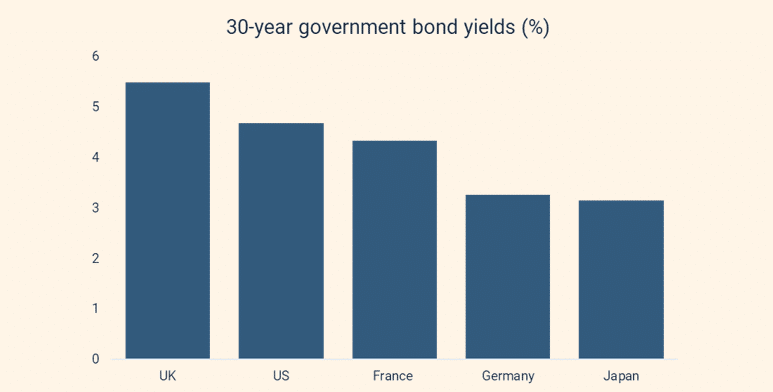

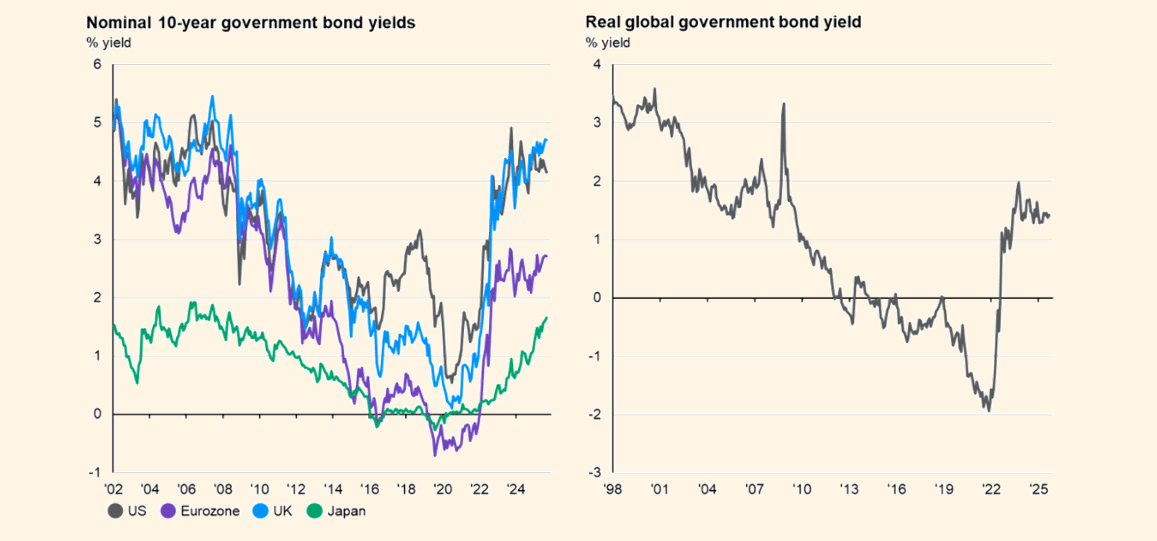

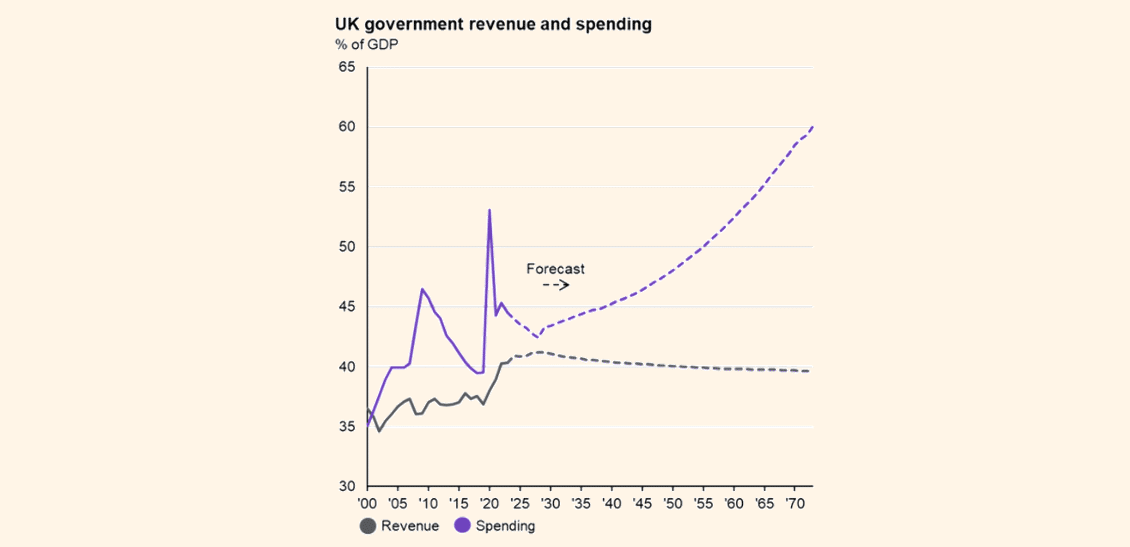

Long-term government bond yields have surged in 2025, rattling investors from Tokyo to Toronto. While this is partly a global phenomenon tied to swollen debt burdens, stubborn inflation and changing investor attitudes, the UK has been hit particularly hard: its 30-year gilt yields have reached levels not seen since the late 1990s.[1] The result is an escalation in borrowing costs for governments, corporations, and households—and in the UK, a narrowing of fiscal space ahead of a crucial 2025 Autumn Budget.

This article explains why yields are rising, what it means for holders of fixed income, why the UK is in especially bad shape, and our exposure to government bonds as we head into 2026.