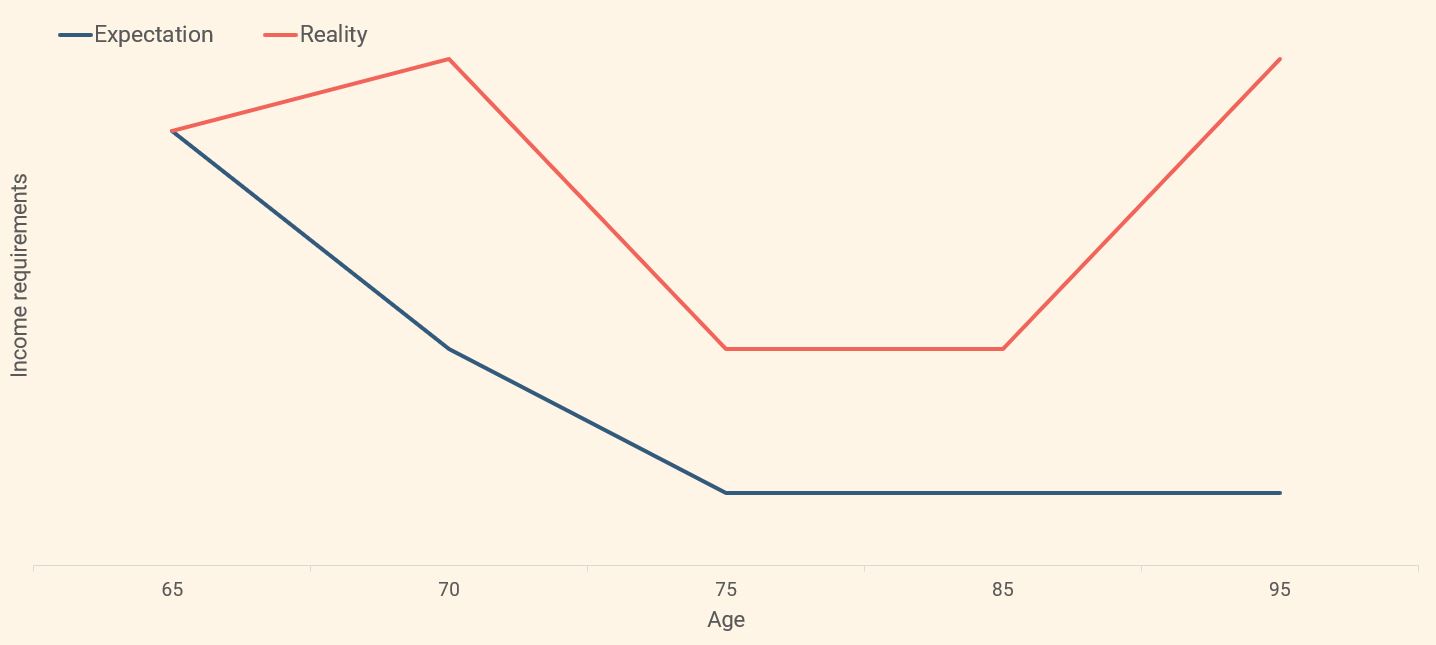

Most people fall into two camps when considering their protection needs in retirement:

1.“I don’t get the point of protection”.

2.“My retirement savings will cover all of my needs”.

I regularly find myself challenging both of these outlooks.

There’s a phrase gathering speed in the industry that refers to retirement as life 2.0. I like this concept as replacing the word retirement with ‘Life 2.0’, highlights that this is going to be a long and active part of our lives. Ultimately, it helps people to engage and take action. To enjoy retirement, you need to feel secure and know your objectives and goals are safe or “protected”. With that in mind, protection in retirement is a vital aspect of planning for “life 2.0”.

I planned my retirement…

People tend to focus their planning efforts on the lead up to retirement (and rightly so!). However, if 2020 has taught us anything, it’s that your plan can easily be knocked off course. The point here is that planning does not stop in retirement. People are living longer and that means your financial plan needs to be agile and able to develop over time.