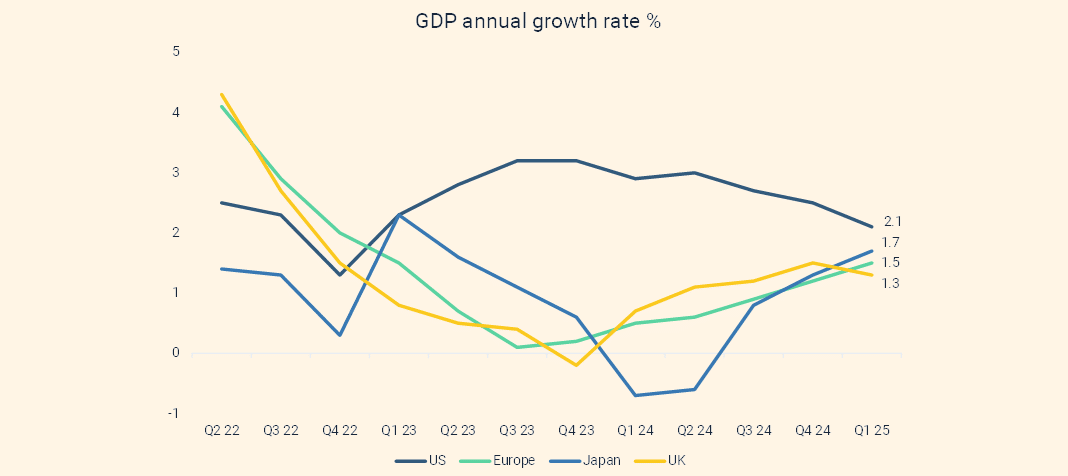

The global economy continues to grow at a healthy pace. First quarter GDP growth remained in positive territory on a year-on-year basis, but as the US economy continues to slow, Japan, Europe and UK growth rates remain on their upward trajectory. These readings came before Trump’s trade wars were announced, so there is more uncertainty around GDP growth from here, and forecast growth rates have been revised down but not into recessionary territory yet. The second quarter GDP growth data should start to show any tariff-related impact.

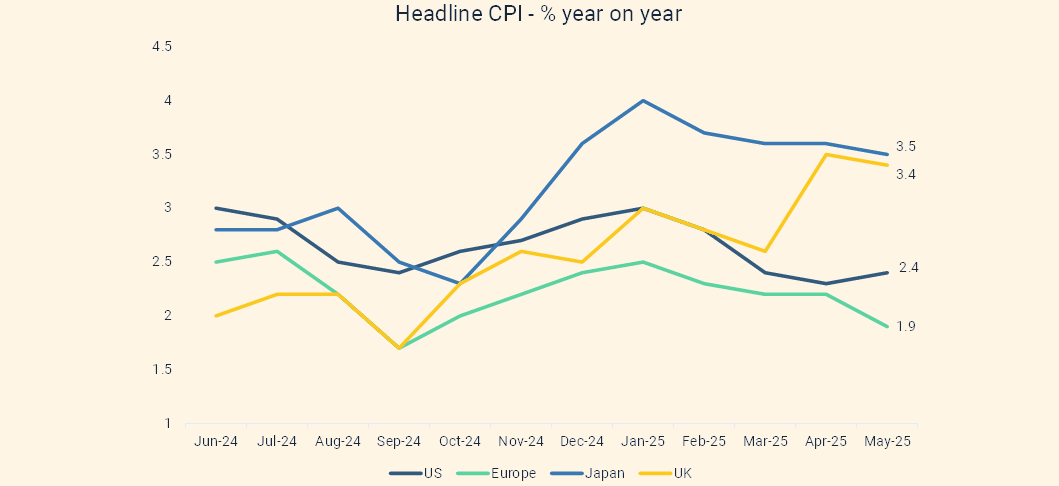

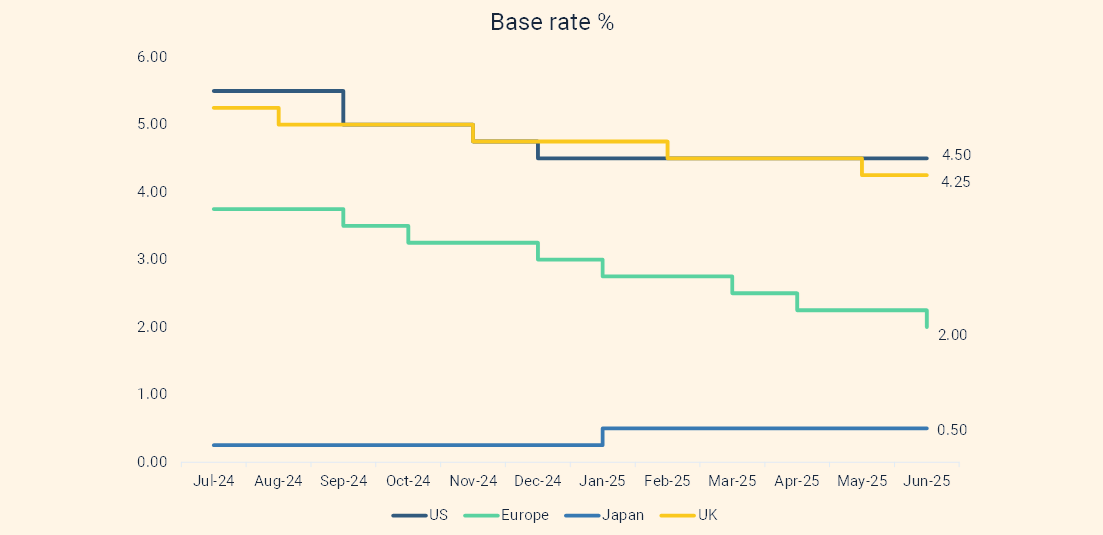

Although there was a slight tick up in headline US inflation from April to May, it currently stands at 2.4%. In Europe, inflation has fallen below the central bank’s 2% target. Whilst in the UK and Japan, inflation is still considerably higher than the 2% target. Services inflation is still relatively high in most regions, and wages continue to rise, highlighting the stickiness of inflation. Central bank speakers have been signalling that they are waiting to see if tariffs have a meaningful impact on inflation, and that this is making them proceed with caution on rate cuts. The May inflation data showed no discernible tariff impact, but this could be due to front-loading of exports before the tariffs came into place. China has experienced deflation for the last four months.