That is the question put to financial planners on a weekly basis and the answer, of course, is never straightforward. It all depends on your own personal and financial circumstances, as well as your over-arching financial objectives.

As we grow older or accumulate more wealth, it’s natural to want to protect this wealth and pass it down to our loved ones in a tax efficient manner. This is commonly referred to as inheritance tax (IHT) planning, estate planning or intergenerational wealth planning.

Gifting is one option, and in this article, we will look at the following.

- Why do we gift?

- How much can you gift?

- Annual gifting allowances

- What is inheritance tax?

- The order of gifting – the 7 and 14-year rule

- Financial planning tip #1: gifts made from regular income

- Financial planning tip #2: don’t just hope you survive 7 years, put a forcefield in place to protect your wealth. Consider whole of life or gift inter-vivos insurance.

It’s important to note that tax planning isn’t regulated by the FCA and any savings you make will depend on your individual circumstances.

How to avoid the 60% tax trap and more…

Did you know that people earning over £100,000 can pay an effective tax rate of 60%?

Why do we gift?

We gift for two common reasons:

- We want to help our family and loved ones now, when they need it, and whilst we can see them enjoy it, as opposed to when we have passed away. This is often called a living inheritance.

- We have a large estate, and we want to reduce the value of the estate so that our beneficiaries pay less or no inheritance tax (IHT) when we pass away.

How much can you gift?

In short, you can gift away however much you like to whoever you like and whenever you like.

If these gifts fall within the ‘annual gift allowances’, or are made from your regular income, they automatically fall outside your estate for IHT tax purposes. Otherwise, you must survive 7 years after making the gift before the gift is excluded from IHT tax calculations.

It might surprise you to know the sequencing of gifts can have a significant impact on the wealth you want to pass on. In addition to the 7-year rule, there is the less well known 14-year rule. “Is that really a thing?”, I hear you say. Well, yes, sorry to break it to you, but it is! More on this later.

Annual gifting allowances

Under current legislation, everyone can gift away £3,000 per year [1]. This is called your annual exemption. Any unused allowance can be carried forward to the following tax year; however, it cannot carry over again.

For example, if you only gift £2,000 during 2023/24, you can carry over £1,000 into 2024/25 resulting in an annual gift exemption of £4,000. However, the £1,000 carried across would need to be used within that tax year.

There is also a wedding allowance of varying amount depending on relation (which must be made before the wedding, and the wedding must happen):

- £5,000 to a child

- £2,500 to a grandchild

- £1,000 to a relative or friend

Wedding gifts can be combined in the same year with the annual exemption. For example, if your grandchild was getting married you can gift them £5,500, made up of the £3,000 annual exemption and £2,500 wedding allowance.

You can also make gifts of up to £250 to as many different people as you like, as long as they have not benefited from any of the gifting allowances.

Do you need help with inheritance tax planning?

Our team are well-versed in estate planning. Our advisers can guide you through the options to make the right decision for you and your family. Get in touch to discuss how we can help you.

What is inheritance tax?

Inheritance tax is potentially payable to HMRC when you pass away. The amount due depends on the value of the estate, minus any debts, and after all available thresholds have been used. These thresholds are the nil rate band (NRB) and the residence nil rate band (RNRB).

At a high-level, the NRB is £325,000 and the RNRB is £175,000, the latter of which is only available if you leave your home to a direct descendant. The standard rate of inheritance tax due to HMRC on amounts over these thresholds is 40%. This reduces to 36% if at least 10% of your estate is left to charity.

If you’d like to understand more about inheritance tax and in particular the available nil rate bands, stayed tuned for my next article. If you can’t wait, check out this video.

The order of gifting – the 7 and 14-year rule

In HMRC parlance, when you make gifts outright to an individual and/or Absolute/Bare Trust, which are in excess of the annual allowances, these are known as “Potentially Exempt Transfers” or PETs. A common reason for making a PET might be to help a child onto the property ladder, for example.

As already stated, to ensure the gift is outside of your estate for IHT tax purposes, you need to survive 7 years from when the gift is made. That said, if the PET is more than the NRB (£325,000), there is gradual tapering on the excess.

| Years between gift and death | IHT payable |

|---|---|

| Less than 3 | 40% |

| 3-4 | 32% |

| 4-5 | 24% |

| 5-6 | 16% |

| 6-7 | 8% |

| 7 or more | 0% |

The longer you survive after making the gift, the greater the tapering [2].

Should you settle any money into a discretionary trust, these gifts are known as “Chargeable Lifetime Transfers” or CLTs. An example of such a settlement might be grandparents wanting to pass money down to their grandchildren. A common reason for this may be that their own children already have a large estate, and so if they were to inherit any more it would be unhelpful for their IHT position.

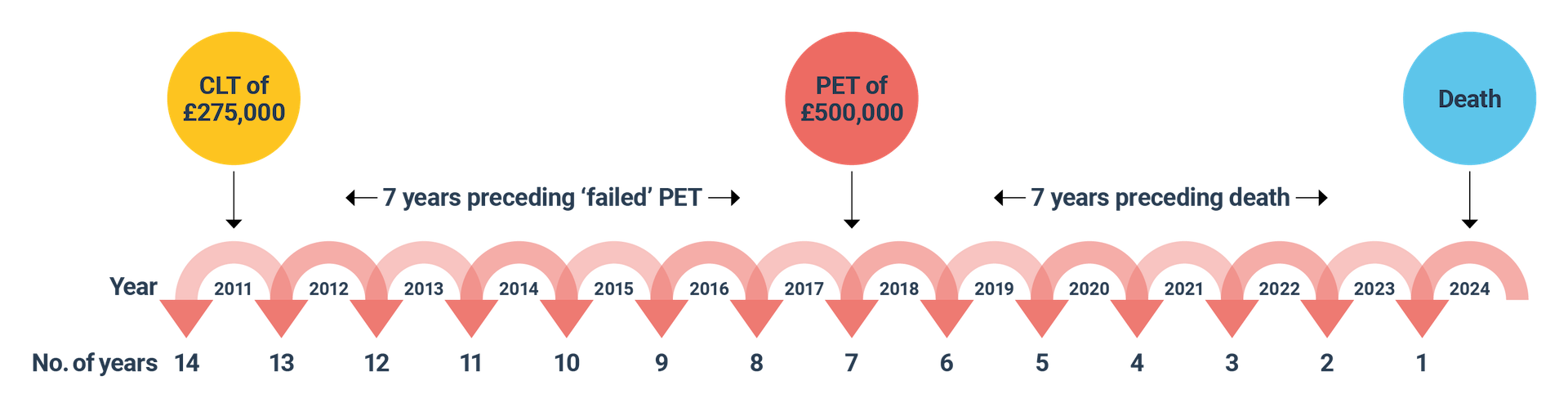

Complications can arise where an individual has passed away and has made both PETs and CLTs. This is because the order of these gifts can result in bringing 14 years’ worth of gifts when calculating the IHT position.

When considering which gifts are liable to IHT, the gifts are placed in the order they were made, starting with the oldest and moving towards the date of death.

HMRC rules are such that any CLTs made in the 7 years prior to any ‘failed PETs’ must also be brought into account.

So, if an individual makes a PET, and dies within 6 years and 11 months, the PET fails. From the date of the ‘failed PET’, HMRC will look back a further 7 years and include any CLTs in their calculation.

In summary, if you are considering settling money into trust as well as outright gifting, it is highly recommended you speak with your financial planner first. Not only is planning key, so is timing. It is also important to keep a record of any gifts you have made, as this will help the executors of your estate should you pass away.

Financial planning tip #1 – Gifts made out of regular income are not counted as gifts by HMRC

Let’s imagine you are retired and each month receive £4,000 of net income from a mixture of personal, company and state pensions; however, your monthly expenditure is only £2,000.

There is nothing to stop you paying £1,000 per month to each of your 2 children to help them financially. This might be to pay for their rent, mortgage, or to pay for your grandchildren’s private school fees, for example. The only stipulation made by HMRC is that:

- you can afford the payments after meeting your usual living costs

- you pay from your regular monthly income

It is worth bearing in mind that these are the general rules of gifting from your regular income but there are some complex details involved so, if you are considering taking this approach, it is probably best for you to speak to an adviser.

If you didn’t want to just gift money to your children in this way, something you might consider as a great way of helping a young family is to pay for their various insurance premiums.

For example:

You have two children who are both married and working. They have two young children of their own, a mortgage, and are at the stage of their lives where financially everything is a bit tough. Their careers are starting to take off, but they are not yet earning enough to be comfortable financially. As a financial entity, both families just about break even, in fact they probably hold some debt as this is the only way they can afford to go away on a holiday each year. Good financial planning isn’t just about building a client’s wealth, it’s also about creating a forcefield around a family’s finances, protecting it, so that if something untoward were to happen, the family can continue.

If one of the adults were to become mentally or physically ill and couldn’t work for 2 years, how would their income be replaced? If one were to pass away, how would the surviving spouse replace their partner’s income, considering they might have to work full time as well as raise two young children?

Covers such as income protection, life assurance, family income benefit, critical illness and private medical insurance are all worth considering. If these covers aren’t already in place, where is the money going to come from? It could come from taking on more debt, or, more likely, the Bank of Mum and Dad.

Do you need help with inheritance tax planning?

Our team are well-versed in estate planning. Our advisers can guide you through the options to make the right decision for you and your family. Get in touch to discuss how we can help you.

Financial planning tip #2 – Gift away and insure any potential IHT

You’ve made some gifts and now you hope to survive for 7 years. This is an option, but it is also possible to insure against the IHT payable on your estate should you pass away within 7 years of making your gift. This can be done by taking out a ‘gift inter vivos’ insurance policy. Or, if you wanted to give yourself complete peace of mind, you might also consider taking out a ‘whole of life’ policy. It should be noted that both insurances will be subject to underwriting.

Whole of life

This type of insurance does exactly what it says on the tin. You would take out an insurance policy to cover the amount of IHT you think may be payable by your estate if you were to pass away and you are then covered for the rest of your life. When you pass away, the insurer pays the money to the beneficiary and they then use this money to pay the IHT bill. One of the principles of insurance is that the premiums of the many will pay for the losses of the few. In this case, because the cover will last for the whole of your life and insurers know they will have to pay a claim, the premiums can be high. However, it is always worth speaking with your financial planner to see how much the premiums would be, as each case will be different.

Gift inter vivos

This type of life insurance can be used to cover the amount of IHT due on a gift if the donor were to pass away within 7 years, with the sum assured gradually decreasing in line with the tapering of IHT due on the gift as the years go by.

Consideration should also be given to the value of your estate as a whole and so, whilst the gift inter vivos plan may cover the IHT due on a gift over 7 years, simple life assurance cover should also be considered as a further IHT mitigation strategy. It is also recommended that these covers are written in trust, so that if you passed away and a claim needs to be made on the policy, the benefits paid out are not included in the value of your estate for IHT purposes.

Gifting, protection, and trusts are complicated areas of financial planning so it is highly recommended you speak with your financial planner, so that together you can work out the best strategy for you and your family.

Do you need help with inheritance tax planning?

Our team are well-versed in estate planning. Our advisers can guide you through the options to make the right decision for you and your family. Get in touch to discuss how we can help you.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

Saltus Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

Related blog posts

About Saltus?

Find out more about our award-winning wealth management services…

Nominated

Good Money Guide Investment Awards 2026

Winner

Top 100 Financial Advisers

Winner

Best Wealth Manager

Winner

Investment Performance: Cautious Portfolios

£10.4bn+

assets under advice

20

years working with clients

450+

employees

97%

client retention rate