Think of your pension like a long distance race… except you don’t know the exact distance, terrain, or how long it will take you to cross the finish line.

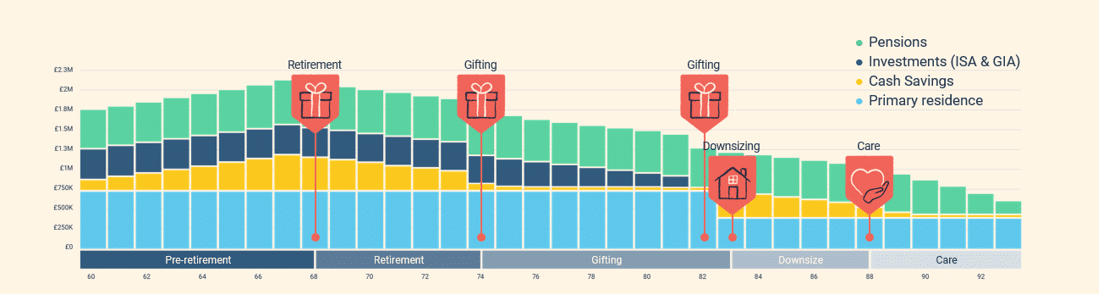

The challenge, therefore, becomes not just about reaching the finish line but making sure you have enough energy, and wealth, to enjoy the journey. With people living longer and spending more active years in retirement, the course has never been more unpredictable. So, the real question becomes: will your wealth strategy go the distance?

Longer lives, greater challenges

According to the latest Office for National Statistics (ONS) figures, a 65 year old today can expect to live well into their late 80s or early 90s. [1] A smaller proportion will reach 100, but the trend is upward: retirements are stretching further than ever.[2]

These are also not passive years. Advances in healthcare, healthier lifestyles, and greater access to wellness resources mean that many people remain active – travelling, pursuing hobbies, supporting family, and starting new projects well into their 70s and 80s.[3],[4]