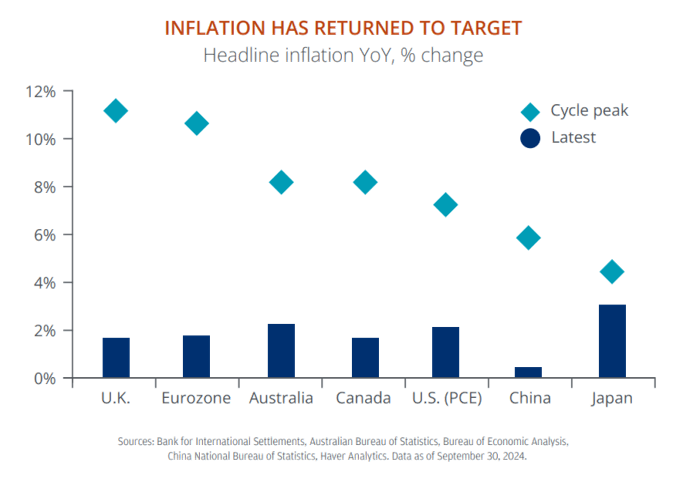

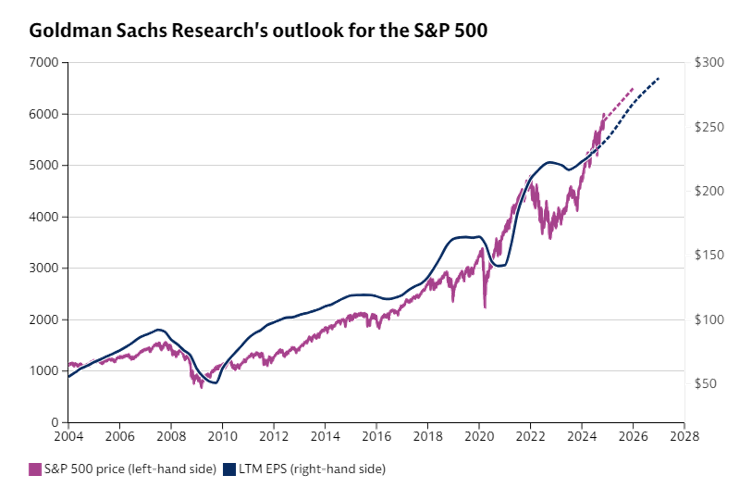

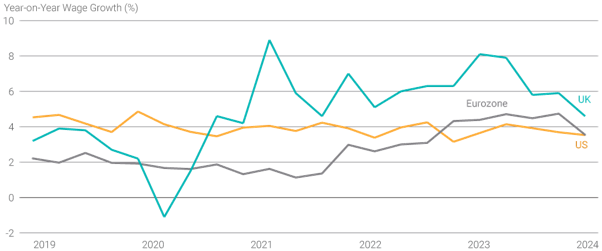

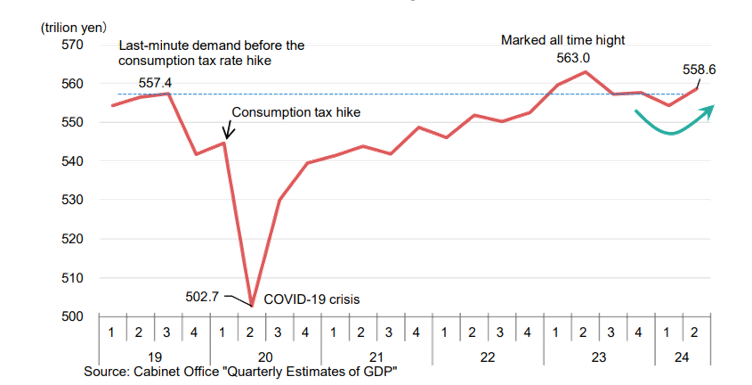

The past year has been remarkable for investors, with favourable economic conditions fuelling unexpectedly good equity market performance. Inflation has eased to manageable levels, economic growth remained robust, corporate profits soared, and central banks shifted to cutting policy rates.

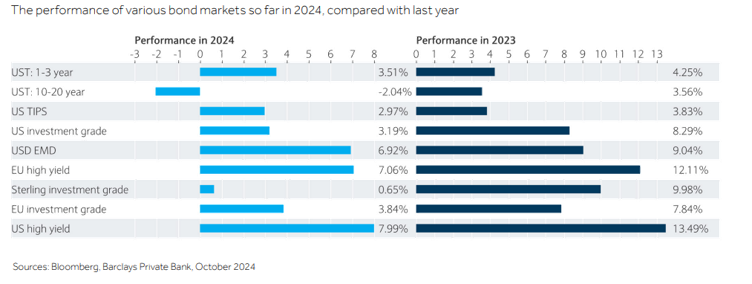

As a result, global stocks delivered impressive returns whilst bonds had more mixed fortunes. At Saltus, our balanced multi-asset portfolios have returned over 15% in the year to November, demonstrating resilience in market volatility. [1]

Looking ahead to 2025, the outlook is promising. The strong market foundation set in 2024 offers a unique opportunity to build on that success. Now is the perfect time to consider whether different strategies and perspectives could help maintain growth within your portfolio.

Key themes

As we approach 2025, several key trends and considerations are set to shape investment decisions. Here’s a closer look at the themes likely to influence markets and how they could impact your portfolio strategy:

Central banks shift to growth support

With the global economy stabilising, central banks are cutting interest rates to encourage growth. These lower rates may have ripple effects on various sectors, from US housing markets to European productivity.