In recent weeks, global events have made headlines and sparked discussions among investors. From heated political exchanges in the U.S., to a strong display of European unity overcoming post-Brexit tensions and the latest tariffs imposed on Canada, China, and Mexico by the U.S., there’s no shortage of geopolitical drama.

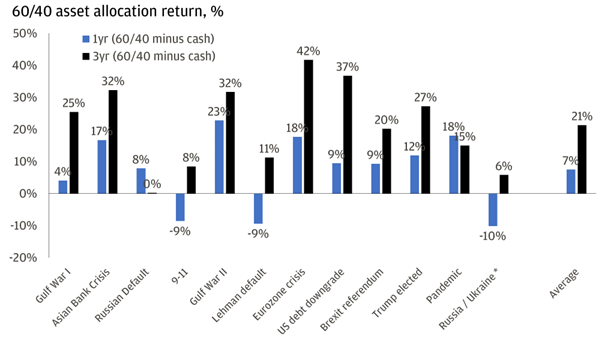

With so much happening, it’s natural to wonder how these developments might impact financial markets. While news cycles often amplify uncertainty, it’s important to distinguish between media-driven sensationalism and the actual effects these events have on investments. Not every headline translates into market turmoil, and history shows that markets tend to adapt and refocus on long term fundamentals rather than short term political noise.

Understanding this distinction can help investors stay focused on their financial goals without being swayed by every twist and turn in global affairs.

How should investors view geopolitical volatility?

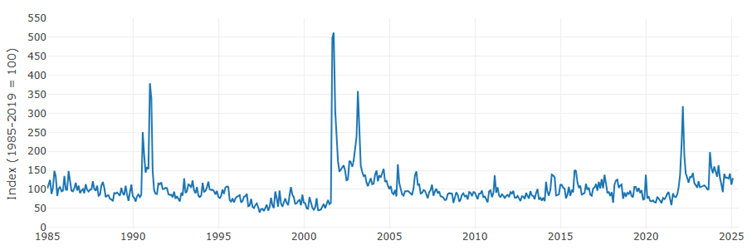

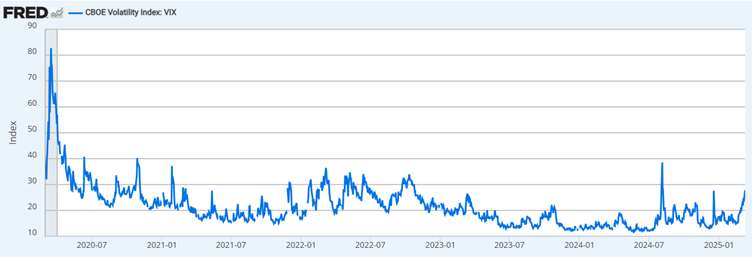

While geopolitical tensions are higher than usual, they are far from reaching extreme levels.[1] However, the current climate of political division has increased market volatility, making uncertainty feel more pronounced.[2] Investors are responding by taking precautionary measures, such as hedging their portfolios with options, essentially an “insurance” against potential downturns.