In your mid-40s with £250,000 in your pension pot? Wondering if you really need to wait until 67 to retire? Perhaps not. With some thoughtful planning and investing, early retirement could be within reach.

Here we will explore the pros and cons, the financial strategies to consider, and what it might take to make a £250,000 pension support an early retirement.

Determining your retirement expenses and setting realistic goals

So, what is a comfortable retirement? The Pension and Lifetime Savings Association (PLSA) and the University of Loughborough have researched the amount required per annum to provide a ‘comfortable retirement.’ They concluded that, for an individual, it was around £43,900 a year. This sum certainly isn’t a lavish figure: it’s enough to provide around £75 a week on groceries, enjoy three weeks of holiday in Europe, and spend around £1,500 a year on clothes, shoes, and gifts.[1]

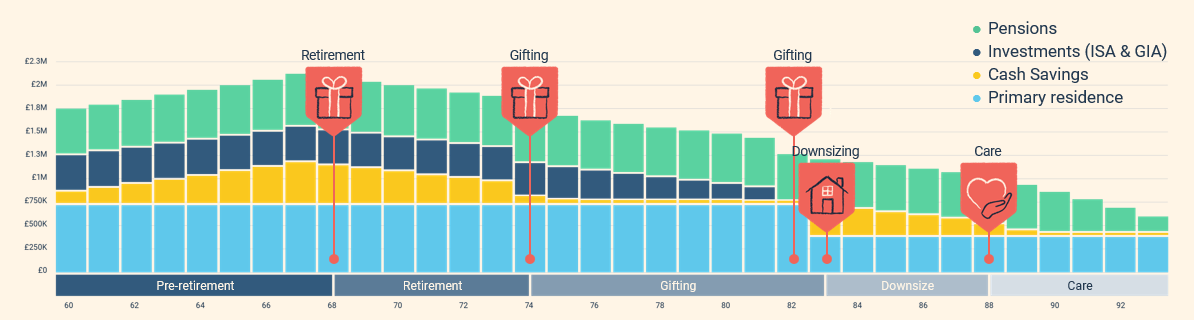

How much you need in retirement is highly individual and depends on your expectations. Think about the lifestyle you want, how much you plan to travel, your hobbies, and whether you’d like to support family members. A useful starting point is reviewing your current annual expenses, recognising that some costs may decrease (such as commuting), others may stay broadly the same, and certain expenses, particularly healthcare, are likely to rise, especially in later years of retirement.