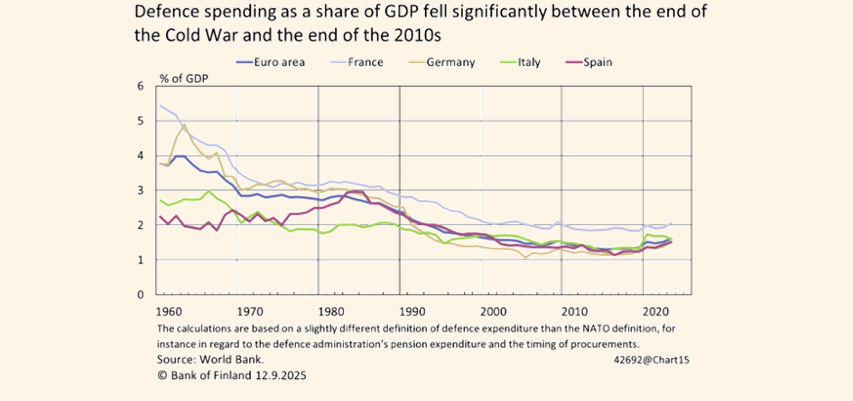

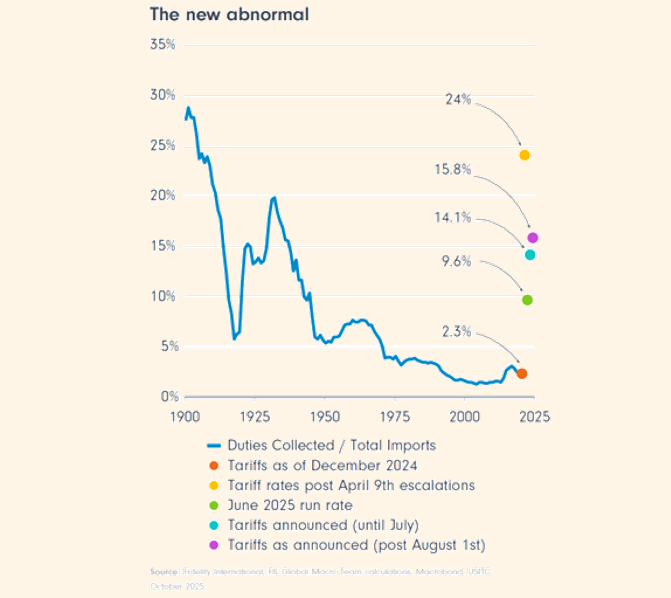

Few years have felt quite as dramatic as 2025. We witnessed the return of Donald Trump who came armed with a more aggressive trade policy, geopolitical tensions in multiple regions, political nightmares, and a fair dose of market turbulence. Yet, as we step into 2026, the global economy and financial markets appear surprisingly resilient. Growth is holding up, inflation is behaving, and corporate earnings – especially those linked to artificial intelligence (AI) – continue to advance.

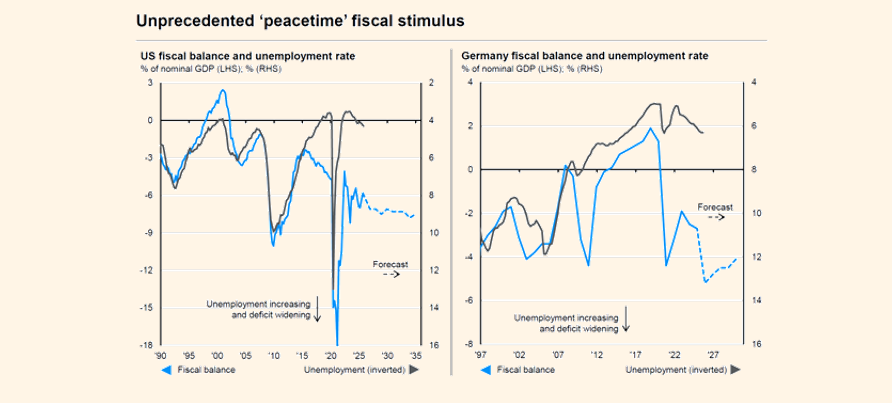

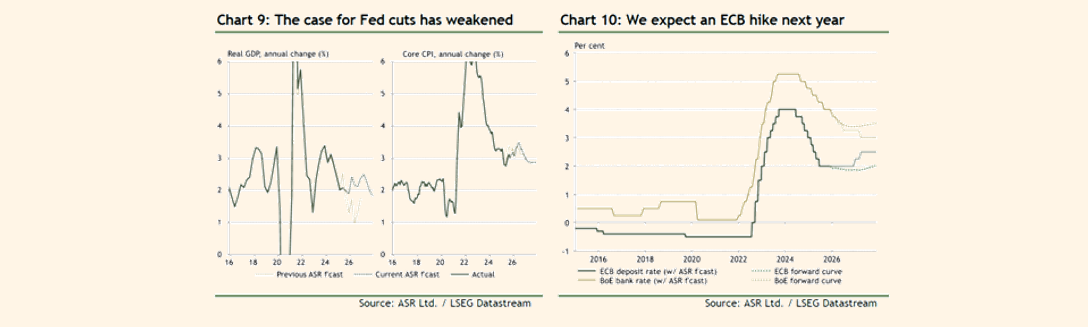

A large part of this has been due to governments and central banks adding stimulus to an already robust global system, and this doesn’t seem likely to go away in 2026.

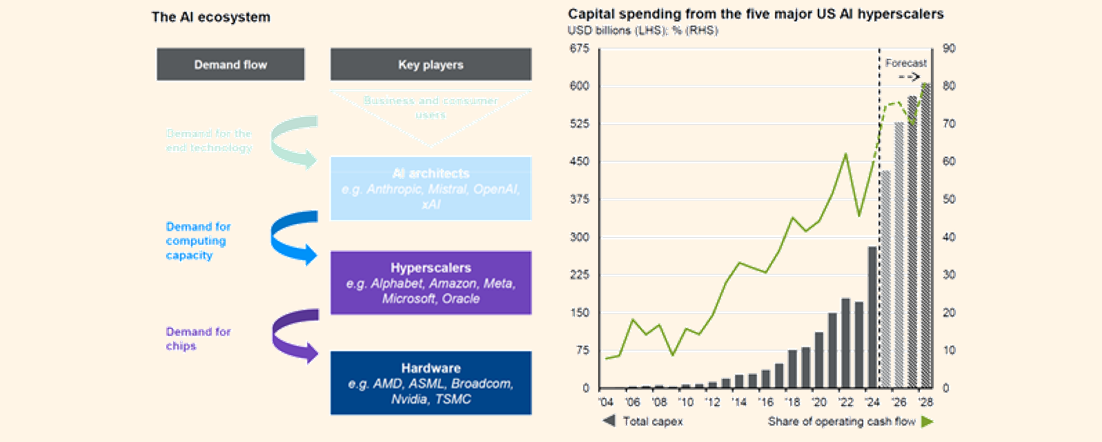

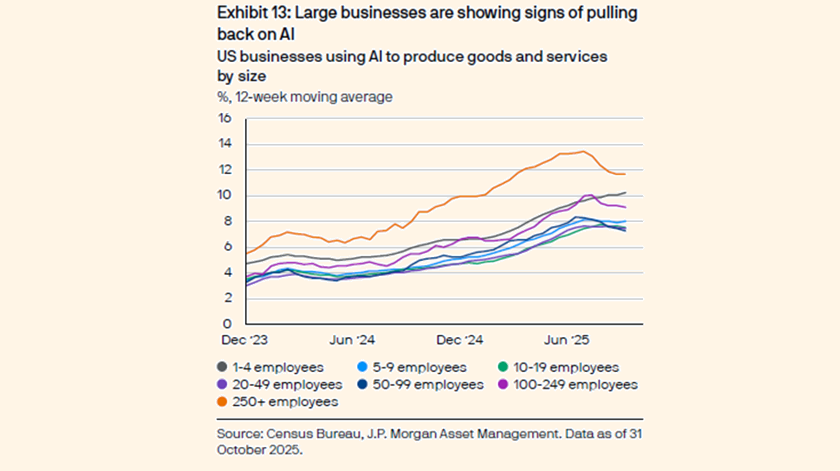

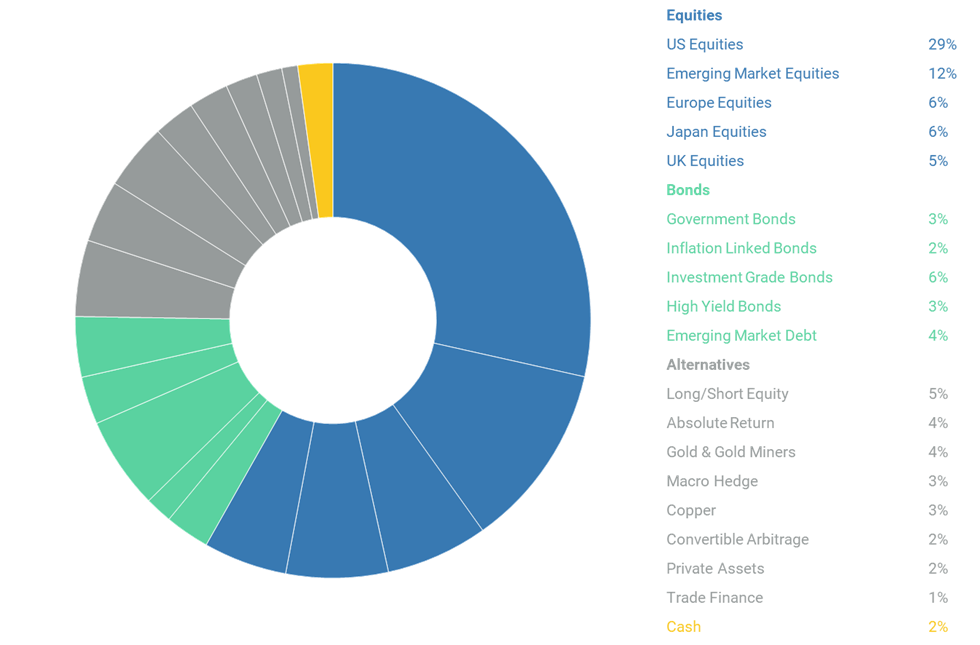

However, we are also in a world with elevated uncertainty. The inflation problem persists, equity markets remain heavily tilted toward a handful of very large technology companies who have spent and have committed to spend vast amounts of money on AI, government finances are in a precarious position, cracks are emerging in private markets, and we are never far away from another geopolitical flare up. The key challenge for investors in 2026 will not be identifying opportunities – they are plentiful – but navigating the risks with balance, perspective, and a healthy dose of diversification.